DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Should I Refinance Student Loans?

Daniel Morgan

Updated – July 29th 2024

Why should i refinance student loans is a question many borrows fine themselves asking. Refinancing one’s student loans can open the door to many different benefits that may assist a person in saving thousands of dollars in monthly payments and interest.

When looking to determine if refinancing federal student loans is best for you, there are 3 major questions you will need to ask yourself and consider.

Questions to ask yourself.

1. Will I save the amount of money i desire to save from refinancing my federal student loans?

The number one reason borrowers consider refinancing student loans in the first place is to take advantage of the ability to save on money their student loan payments.

This is a very good reason why should i refinance student loans.

So be sure that you are putting the amount of money back into your pocket that is satisfactory to you.

Also, if you work as a federal employee or for a specific not-for-profit employer, such as teachers, lawyers, or doctors.

Furthermore, you may be eligible for student loan forgiveness after making consistent payments over a set period of time.

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

2. Will I ever want to use my federal student loan benefits?

This question of more geared toward borrowers that may be considering refinancing their federal loans along with their private student loans. Federal student loans include many benefits such as deferments and forbearance for those tough months that may come in time.

When a borrower refinances their federal student loans with their private student loans they lose those benefits that were associated with their federal student loans.

This may be why should i refinance student loans with private student loans may not be the best idea.

Also understand that once your federal student loans have been refinanced into a private student loan, those loans cannot reconvert back into a federal student loan. So, make sure you consider this.

In many cases it may be better for a borrower to refinance their federal student loans in a government student loan program to secure those federal rights.

Also, keep those federal student loans separate from their private student loans.

3. Do i plan on using any of my Government student loan repayment options?

The Department of Education of the federal government has structured many repayment options based around the attempt to make student loan repayment much more feasible for federal student loan borrowers. However, certain conditions apply.

Some of these programs consist of Pay As You Earn, and the Revised Pay As You Earn plan, Income-Based Repayment, Income-Contingent Repayment. Also, the new income sensitive repayment plan.

These plans are subject to eligibility and government approval. However, they can be huge asset if you may be suffering a economic hardship, are in need of a financially based payment due to lower income or possible job loss.

However, if you qualify for student loan forgiveness with one of these options you may have to pay a higher tax for the year you received your student loan forgiveness.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Let’s talk a little bit about private student loan refinance

Private student loans can be refinanced as well.

Private student loans do not offer the same repayment options and possibility for student loan forgiveness as a federal student loan refinance has.

One benefit of refinancing private student loan is that you have a higher chance to get a lower interest rate.

Private student loans can not be refinanced with the federal government. But, can only be refinanced with a private refinancing company.

Therefore, you may be limited in the flexibility of changes to your agreement once you have refinanced your private student loan.

Why should i refinance student loans in cases of private student loans really depend on the borrowers desired results.

Also, the borrower needs to think about what makes sense.

Unlike the federal student loan refinancing which does not use your credit score as a determining factor toward your eligibility.

Private student loan refinancing will require the evaluation of your credit to determine what you will qualify for.

Also, what interest rate will be available to you.

Student Refinancing terms

When considering refinancing your federal student loans it is important to take note of:

What the Estimated Monthly Payment will be

The Interest Rate Loan

Life or how long will you pay on the loan

Federal Student Loans

On federal student loans the repayment time is usually up to 30 years to repay your student loans.

Student loan consolidation or refinancing companies generally offer options with terms short as 5 years. And up to 20 years.

Federal student loans also when refinanced will come with a fixed interest rate.

And, almost always the same rate during the full term of repayment.

So, why should i refinance student loans on a federal account.

We cant speak for you, but for many others fixed works.

Private Student loans

With Private student loans interest rates do not always come fixed.

Furthermore, it is very possible that you may be offered a variable interest rate.

A variable interest rate is an interest rate that can change as national economic conditions change.

This can be viewed as a negative in some conditions. Generally it is safer to obtain a fixed interest rate if possible.

When you decided to refinance your federal student loans or your private student loans. Make sure you compare to make certain that the monthly payment, interest and loan period is to your satisfaction.

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

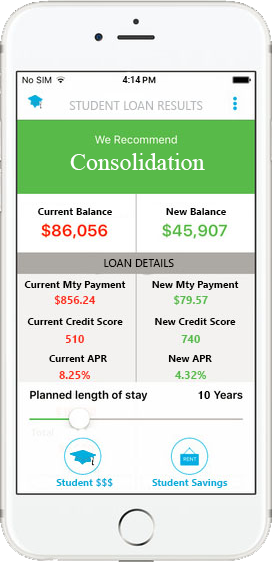

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments