DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2021

…I made the call and walked away with my loans forgiven!

You Should Call

Consolidation and Affects on Credit

Daniel Morgan

Updated – Jan 12th 2021

Are you thinking about buying your first house or maybe you are seeking to get a loan to start your own business. Truly the list goes on, there are many goals you could have great interest. In Which, your credit report and credit score will end up being the determining factor in your approval or rejection process. Which is one reason we want to discuss consolidation and affects on credit.

Rental rates, insurance rates, automobile loans, home mortgage loans and even job placement all are subject to your credit report and credit score. With good credit, you will have a much better chance loan approvals and lower interest rate offers on many of these financial products with lenders, banks and financial institutions.

However, a low or bad credit score in most cases will result in much higher interest rates which will cause you to pay more for a product than its value. A low or bad credit score can result in bank penalties, cancellation charges, credit card rejections and loan application denials.

The question you and many others may be asking is: Does my student loan affect my credit score? And the answer is YES! your student loans are affecting your credit score in a variety of ways, many of which you may not have been aware of….

So “how does student loans affect your credit score?”

Student loans generally fall into the same category as automobile loans and home mortgage loans.

These kinds of loans are considered as installment loans. An installment loan typically starts with a balance that is paid back over time and has a set number of repayments for that time period.

Does it matter if your student loan is private or federal?

NO, all installment loans are calculated and regarded in the same way on your FICO score, therefore the type of student loan you have does not have an impact on how the loan is evaluated.

Student loans do not have their own their own credit category system.

Is getting more student loans bad for my credit?

Getting more student loans is not ideally bad for your credit score but doing can have a negative impact on your credit report.

Your credit score and your credit report are not always regarded or evaluated the same way.

For example, you may have a 700 credit score, but your credit report may document a number of reported outstanding debts, unpaid balances and a not to impressive payment history.

For Example, Home mortgage lenders and banks evaluate your debt-to-income ratio. This process is used to compare your total monthly debt expenses to your total income.

When this ratio is calculated to be to high, stating that there is too much debt in relation to your income, chances are you will be turned down for your mortgage loan application.

So therefore, ultimately your student loans can affect your credit score, they have a greater impact on affecting your eligibility to take out other loans and establish a good credit report.

Your Student Loan Monthly Payments are Important element

So we know that your student loans themselves does impact your credit, but what about the student loan payments?

Probably the most impactful aspect of student loans on your credit is your monthly payments. More specifically, if you are making your payments on time and in full, part or interest only. This is important to understand regarding consolidation and affects on credit.

Changes to your credit score can depend on many factors. Payment history represents 35% of your credit score. This is the most regarded part of your FICO score, by being late on a single payment can cause your credit score to fall.

For example:

Philip currently has a credit score of 670. If Phillip becomes just 30 days delinquent on lets say his student loan payments, his credit score could drop 50 to 90 points from that one account.

Carla, who has a great credit score of 790 could suffer even more than Philip. With a 30 day delinquency Carla’s score would drop by about 100 to 120 points.

Also, if your student loans enter into default or gets sold to a collection agency your credit score as well as your report will suffer an even greater negative impact, often taking your credit score from very good to very bad in an instant. Just another note on Consolidation and Affects on Credit. ‘popmake-{getitnow}’

How student loans can positively affect your credit

Your student loans do not have to be a bruise to your credit, in fact it may be possible for your student loans to become a credit score improvement agent.

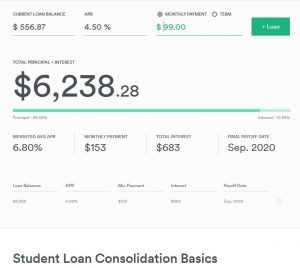

Let’s say your credit is not so good, you have paid on your student loans and as a result your credit score has encountered significant drops. You may want to consider refinancing or consolidating your student loans. When you consolidate your student loans a lender can payoff your delinquent student loans and give you a new loan.

The new loan will be somewhat of a new start, providing you a second chance to make your payments on time, build new credit history for your student loans and reduce your income-to-debt ratio, if your payments are eligible to be reduced.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Key things to take away and remember:

- Student Loans are installment loans and are report just as other loans for your credit report and credit score.

- Getting additional student loans has a greater impact on your credit report rather than your credit score.

- Your student loan payments will make the greatest impact on your credit score. Make your payments on time or seek professional help to help make your payments more affordable

- Student loan consolidation can help improve your credit if your credit score has already previously been negatively impacted by the student loans.

Now you that you have a better understanding on Consolidation and Affects on Credit. You can decide if consolidation is an option for you.