DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

How to Start Paying Student Loans

Daniel Morgan

Updated – Jan 9th 2024

How to Start Paying Student Loans

What can compare to the satisfaction of running through the finish line of college graduation. It’s a feeling millions of us each year after four long years of hard work where able experience.

But hiding in the background where these little things called student loans. After the hat has been thrown high in the sky what comes back down is student loan repayment notices. The average student loan monthly payment in or nation is approximately $357.00 a month. So with that said, one of the first questions you will need to get answered is, “how much will my student loan payment be”.

But how do you learn how to start paying student loans with all the confusion and stress of starting your new life and career waiting in the balance. That alone can cause enough frustration for a new graduate to wonder how to get out of paying student loans altogether.

In this blog article we are going to help you by sharing some important tips that will assistance on how to start paying student loans.

1. Gather All Your Information

We understand student loans is one those things we all prefer to just pass by give no thought to and put in the back of our minds. However, we have to use our wits and get full informed.

If you have already past the time of your exit interview after graduation no problem. Therefore, the next best thing to do is open all the mail you have been receiving from your loan holders. This information is very important as it will inform you of how much will my student loan payment be. Also, your interest rates and some of the basic terms of your student loan repayment agreements.

One of the first mistakes new graduates make is assuming that they only have one student loan and only owe one lender. Do not make this mistake, pull your credit report. Because, many services will tell you that you only have one loan with them but in actuality you may have multiple loans with that one servicer.

2. Seek the Specifics

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

When it comes to paying back on your student loans you need to know the details. One important detail is understanding your grace period. Your grace period is the time rewarded to you after graduation that you have before you will be required to actually start paying back on the loans. Generally, grace periods are around six months, you need to know when it started for you so that you can calculate when it will end.

Once you know how long and when you grace period will be ending, you then need to focus on finding out exactly how much you own or how much student debt you have. Usually you will have a general idea of how much you owe back on your student loans but you may not be aware of how much that amount is with interest.

If you have multiple student loans with different companies, your interest can become the boogeyman for your goal of paying your student loan of quickly.

Also you want to find out the details around your monthly payment. Ask questions such as, “how much of this payment will effect the principal balance of my loan” and “ will this monthly payment amount cover all of my student loans fully?”

These questions are important to pose to your service because many servicers will give you a minimal monthly payment that is too low or not enough to actually pay the loan down.

This will cause a situation where you could be paying your loan for years and years and never really see any impactful deduction on the overall balance total

3. Think and Be Strategic

Again think about those every important questions: how much will my student loan payment be? And, how to start paying student loans?

You want to know the answers to those two questions to help you develop the best method for you. And, not everybody will just the same road map.

Be we suggest that you may want to consider to start by paying off your higher interest loans first. Student loans with higher interest rates typically take more time to pay of and end up costing you more money in the end.

Pay a little more on your loans if possible. Most services will only ask you to pay whatever your minimum payment is per month. But just paying the minimum will not produce the effects you probably want to see as far as how to get out of paying student loans. However, if you pay more each month than the required amount you can pay the loan of much faster and free yourself of paying on your loans for many years.

4. Have a Plan B

Unfortunately, not all of us graduating from college will come right out of school and immediately start making competitive income. In addition, even land a job in our field of study starting out.

Because of this you may not be able to start paying back on your student loans right away. Also, you may not be in position financial to meet the minimum payment being billed to you from your servicer.

In these situations a new graduate may want to look into alternative repayment options and income-driven repayment plans.

In most cases these an income-driven repayment plan could provide significant support to your situation.

Income-driven repayment plans:

Income-based repayment

Income-contingent repayment

Pay As You Earn

Revised Pay As You Earn

With each of these options your monthly loan payment is capped at a percentage of your discretionary income, and your repayment term is extended. That can dramatically reduce your payments, freeing up more money in your budget for your essentials.

Forbearance

Forbearance is not a repayment option. However, is a feature that will allow your monthly payment temporarily postponment. Or, suspended for a short period of them

This is value, when you need more time to position yourself to be able to make your student loan payments.

5. Seek Professional Help

Don’t worry help is available. There are companies out there that provide paid student loan assistance programs and assistance.

Some may feel like managing their student loans is like a piece of cake. But, one seemingly insufficient mistake could cost you thousands of dollars more to pay over the life of your loan. Or end up stuck with monthly payments that are difficult to afford.

It may be will worth the expense to acquire professional help, it could be the difference of thousands of dollars

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Finally…

So remember my friends, when the question of how to start paying student loans comes to mind.

Therefore, remember these important steps:

- Get informed

- Get details

- Be strategic

- Have a backup plan

And most of all ask the number one question….

How much will my student loan payment be?

how much will my student loan payment be

Other Related Articles

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

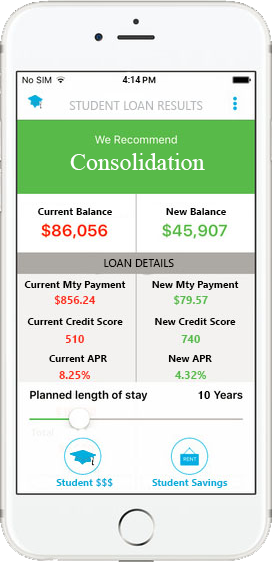

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments