DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Student Loan Forgiveness for NonProfit

Daniel Morgan

Updated – Jan 7th 2024

Non Profit Loan Forgiveness

Non Profit Loan Forgiveness is a student loan forgiveness program for nonprofit employees or companies that work for or in a 501c(3) tax code organization.

Also other organizations not normally recognized as a “non-profit” worker.

Non profit student loan forgiveness is nationally known as the cream-of-the-crop for best student loan forgiveness programs available.

Non profit loan forgiveness falls under what most know as the Public Service Loan Forgiveness program or (PLSF for short).

The student loan forgiveness for nonprofit program became very popular after President Obama and the Obama Student Loan Forgiveness Reformation Bill was passed.

The bill added additional value to the program and opened the door for more college debt forgiveness to become a real possibility for students seeking school loan forgiveness.

One thing we can be definite about is that, non profit loan forgiveness is easy to understand and simple to follow. For many other student loan forgiveness programs, these trues could not be stated for.

To obtain student loan forgiveness after 10 years, you must work for a qualifying employer that is under the tax code 501c(3) for at least 30 hours per week.

You also need to make your monthly student loan payments on-time and in full.

Will Non Profit Loan Forgiveness Really Benefit?

Based on new 2024 case studies, student loan forgiveness for nonprofit was found to be the student loan forgiveness program for saving the most overall on college loan debt and how to get out of paying student loans.

Student loan forgiveness for public service or PLSF forgiveness grants is for any federal student loan borrower that works for a qualifying non-profit organization.

And, that makes on-time monthly student loan payments for 120 months to earn student loan forgiveness after 10 years.

This is much quicker than any other student loan forgiveness non profit program.

And is exceptionally beneficial for students with higher loan amounts, especially like persons that went to expensive colleges and educational institutions with special interest. Specially like law schools, medical schools and doctoral programs.

Get Your free forgiveness consultation?

CALL NOW

833-782-7133

How Can Non Profit Loan Forgiveness Happen?

When qualifying for student loan forgiveness for nonprofit you must meet the following criteria and qualification.

Here is a small list of the core types of qualifying organizations for public service loan forgiveness:

- Non-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Have a Federal Direct Loan or Direct Consolidation Loan

- Other types of non-profit organizations that provide certain types of qualifying public services

- Complete 120 monthly payments on your student loan debt

Eligible Loans for Non Profit Loan Forgiveness?

The only loans received under the William D Ford Federal Direct Loan Program qualify for non profit student loan forgiveness.

However, all the loans like these below:

- FEEL Loans

- Stafford Loans

- Perkins Loans

- Grad Plus Loans

WILL NOT qualify for student loan forgiveness non profit.

However, if you have one or more of those loans, you might be able to consolidate them into a Direct Consolidation Loan, which would then be eligible for non profit loan forgiveness.

Qualified Employment – Student Loan Forgiveness for Nonprofit?

There’s a huge variety of jobs that qualify for the Public Service Loan Forgiveness program, including each of the following positions:

- Employed for a Federal, State or Local Government Agency

- Employed with a Section 501 (c)(3) non-profit tax exempt organization

- Employment in the Armed Forces, emergency divisions, law enforcement

- Working in public health services, public education, park and recreation or school services

- Positions in early childhood education, public service for people with disabilities or public service for the elderly

Basically any employment related to public service work will qualify for loan forgiveness non profit benefits, but a position with an organization that’s qualified as a non-profit 501(3)(c) will guarantee PSLF forgiveness.

Most People struggle with what full-time employment is. This means your total hours have to average out to 30 hours a week within an annual year.

Consequently, part-time employment is unqualified.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

What Payments Count Toward the 120 Threshold?

Student loan forgiveness after 10 years

To acquire non profit school loan forgiveness, a federal student loan borrower must make 120 monthly student loan payments that:

Are Not Late – payments must not be made after their due date, all payment will have to be on-time, and by your Student Loan Repayment Plan schedule

Is Paid In-Full – none of the 120 payments can be partial, but must be in the full amount due according to your repayment plan

Are According to Schedule – making all of your 120 payments in any number of months less than 120 will not be according to schedule. All payments must be according to the schedule of your repayment plan

Only payments made after October 1st, 2007 will count toward your 120 payments. The earliest that you can possibly qualify for non profit loan forgiveness is October 1st, 2021.

Therefore, this year will be the first group of people who will receive non-profit loan forgiveness, as long as President Donald Trump’s Student Loan Forgiveness Program does not get passed into law

What Repayment Plans Are Qualified for Non Profit Loan Forgiveness?

-

As of 2024, all Income-Driven Repayment Plans are eligible to participate in this program.

Payment schedules have to under an income-driven repayment plan. If loans not under an Income-Based Repayment Plan the payments will not go toward 120 months for student loan forgiveness non profit.

Which repayment plans are considered to be “Income-Based Plans”?

These are plans regarded as income-Driven/Income-Based for federal student loans

- Biden SAVE Plan

- Income-Based Repayment Plan

- Pay As You Earn Repayment Plan

- REPAYE Repayment Plan

- Income-Contingent Repayment Plan

- Income-Sensitive Repayment Plan

These are the only student loan repayment options that will contribute to non profit student loan forgiveness and student loan forgiveness for nonprofit.

Payments will not count toward any public loan forgiveness at all, unless enrolled in an income repayment plan.

What is the Best Move For Me to Make?

Our advice to any borrower of Federal student loan debt would be to seek an income-based student loan repayment plan very quickly.

Income based plans are generally the best and most affordable way to pay back on your student loan debt.

Your interest is covered on a subsidized loan, and if you are willing to make payments to cover interest accumulation.

So that it isn’t capitalized in to your loan regardless of the possibility of eligibility for non profit student loan forgiveness benefits.

Another reason to definitely enroll into one of the income-driven plans is that if the removing of non-income based plans from eligibility for PSLF forgiveness ever occurs.

You won’t have to worry about losing eligibility for non profit loan forgiveness.

What are the Limitations for Non Profit Loan Forgiveness?

As of 2022 the legislature regarding the student loan forgiveness laws, the nonprofit student loan forgiveness program does not have a cap, this means that your loans will be forgiven in their entirety no matter how much you owe.

We believe a reduction in benefits is very doubtful. And, for now there’s no limit to the amount on forgiveness.

Therefore, if you can take full advantage of non profit loan forgiveness.

Should Borrowers Expect Any New Changes?

Talks of a cap introduced at $57,000 for student loan forgiveness for nonprofit program happened.

The Federal Government discussed this change a few years back. Still, we have no indication that this change will ever become law.

However, because discussions were public and possibly serious changes. Therefore, we consider it necessary to inform you of this.

Hopefully, we will not see any depressing changes to the PLSF forgiveness programs.

We strongly believe no major changes will happen anytime soon.

But again, just to be straightforward with you, we would rather you be aware of the possible changes that could impact the student loan forgiveness program.

And, that could arise with the non-profit loan forgiveness programs.

Here are some student loan forgiveness reform topics in discussions:

- Higher loan borrowers with debt over 57k will have to make 300 payments to qualify for loan forgiveness

- Married borrowers determining their income for the purposes of calculating monthly student loan payments will no longer be able to separate out their spouse’s income

Get Your free forgiveness consultation?

CALL NOW

833-782-7133

How To Apply For Student Loan Forgiveness For Nonprofit?

In our opinion, if you don’t have a ton of time to researching and are somewhat confused. Or, if you would prefer the expertise of a professional to get help with dealing with your student loans.

Then we would recommend you calling GOV Student Loan Service.

They are an organization that offer paid services. Services like extensive personal loan research, general document preparation, and debt consolidation.

This is after they have completed and presented a full analyze of your student loans.

You can call them and speak to one of their experts and get some advice for free. Also, options for paid assistance is available.

We advise calling them because, they will quickly tell if you actually qualify for the Non-Profit Forgiveness Program.

When you call, just tell them about your student loan and employment status. Then ask if you’re eligible for the Public Service Loan Forgiveness Program they will gladly give you your information

Of course, agencies like GOV Student Loan Service can most definitely help.

They can complete the entire process for you and make things a hell of alot easier. But, still understand this is something you can do on your own.

What they can do is save you time by reducing the amount of research you have to do. Furthermore, by taking care of all your paperwork for you.

To Contact GOV Student Loan Service, call 833-782-7133.

Do You Need Your Help!

Did this article help increase your understand of non profit loan forgiveness?

If so, please send links to it from your Blog. Also, email it to a friend, send it out via Twitter, and share it on Facebook!

We would love your help in our efforts to educate and spread the word about non profit loan forgiveness. Also, about how it could change a person’s life, family and financial conditions.

So please spread the word, tell someone else to visit this article or reach out to us. So they too can have a better understanding on student loan forgiveness for nonprofit

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

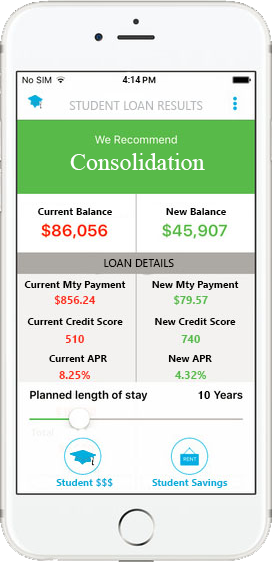

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments