2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Defaulted Student Loan Forgiveness

Daniel Morgan

Updated – Jan 30th 2024

Defaulted student loan forgiveness may not be exactly what you thought. Student loan forgiveness is a federal program offered to qualified federal student loan borrowers. So pose the question, “can you default on student loans” and the answer to that questions is, definitely yes! Borrowers that in default must get their student loans out of default before they can become eligible for federal student loan forgiveness.

Although student loan default is a very serious matter and can definitely hinder your ability to take advantage of different benefits and rights. There are options availability to help you get out of default.

If there where a such thing as defaulted student loan forgiveness. this would definitely be the closest thing to it.

Once your student loans are out you default you will be well on your way to student loan forgiveness.

Need Help Getting Out of Default?

CALL NOW FREE HELP

833-782-7133

There are four options to get out of default

1. Paying of Your Student Loan

If you already have the balance you owe on the defaulted loan in a savings account or can get the funds to pay the loan off, then you can send your payment to the US Dept of Education.

The DOE can expect your payment in the form of credit or debit card, check, money order or cash by mail or delivery.

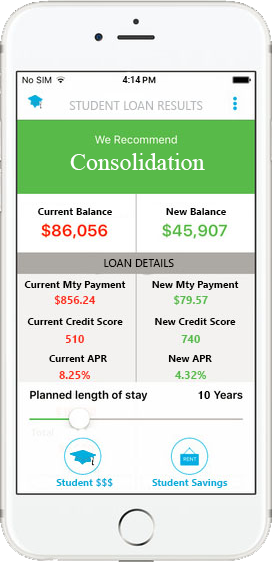

2. Student Loan Consolidation GOV

Generally, in some cases you may be required to make three consecutive on-time voluntary payments on the student loan before you are allowed to consolidate the student loans.

However, if the three payments look to be a challenge for you to commit to, then you can still consolidate your student loans if you agree to an income driven repayment plan.

Be sure to find out if student loan consolidation gov is best for you and your student loan type.

For example: If you have a Parent PLUS loan and you consolidate it, you will loose your options to income driven repayment plans.

If you just have FFEL or Federal Family Education Loans or Perkins Loans and you choose to consolidate the student loans you will not be eligible for student loan forgiveness or Public Service Loan Forgiveness programs.

Can Consolidation Help?

CALL TO FIND OUT

833-782-7133

3. Rehabilitation or (Rehab)

Collection agencies offer rehabilitation. Default account are handled over to collection agencies.

The student loan rehabilitation program requires that the borrower of the defaulted loan makes nine consecutive on time payments for nine months. The borrower must select an income driven repayment plan when choosing the student loan rehabilitation program to get out of student loan default.

Understand, also that any wage garnishment, tax return or social security payments being make will not go toward the nine rehabilitation payments.

Here are some warnings you need to take heed to as well when considering rehabilitation.

Student loan rehabilitation is a one time ordeal, this means once you use rehab as your scapegoat to student loan default freedom you will not be able to use it again in the future if you end up in default again.

Added Collection cost and fees:

student loan rehab is generally an offered by the collection agency, collection agencies are looking to make a profit off of you as well. Therefore, be aware that the collection agency will place or add additional interest, fees, cost and penalty cost to your loan balance. These cost can be up to 16 percent of the unpaid balance and interest on the loan.

Misrepresentation to borrowers:

collection agencies have been found to repeatedly manipulate borrowers into thinking they are dealing with the servicer on the loans. Most of the time the servicer and the collector are two separate companies. The collection agencies likes to use this mix up against borrowers. When speaking with a collection agency about the student loan rehabilitation program make sure you confirm their name and title and notate when the call was made. Also request everything in writing.

Payments:

After you have completed the rehabilitation program, your monthly payment will revert back to a standard payment, this means that you will be requested to make the same payment you could not make in the first place that got you into default. Because of this you could end up right back in default after completing the rehab program

Wage Garnishment:

If you are being garnished and you opt into the student loan rehabilitation program you will still be subject to the wage garnishment payments while making your nine rehabilitation payments at the same time. This could be every financially taxing for a borrower seeking to get out of default that is also suffering a wage garnishment.

4. Cancel Student Loans

Student loan cancellation is not available for all situations, only very specific situations will result in a cancellation of a student loan debt. But if you are in default on your student loan, cancellation may be an option for you.

Even Though, the above situations can entitle a borrower to possibly obtain the cancellation of their student loans by law, proof of these matters must be provided, verified and approved.

However, if your application is found to be true and is approved. Not only will the defaulted student loan be canceled.

But, generally all of your outstanding student loan balances will be subject to the loan cancellation as well.

Defaulted student loan forgiveness is not the same same as cancelling a student loan.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

5. School Shutdown or Closed

if you attended a school that closed while you were enrolled, or if you withdrew 120 days before the school shutdown or closed and you were unable to complete your program due to the closing. The types of loans eligible for school closure loan cancellation are Direct Loans and FFEL, PLUS and Perkins loans

Key Note

You can get out of student loan default. Is defaulted student loan forgiveness a reality? well student loan forgiveness can be a possibility for you in the future.

But, if you are in default, you must get your loans out of default first to even have a chance.

Other Related Articles

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments