2023

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Student Loan Consolidation

Daniel Morgan

Updated – June 30th 2023

Student loan consolidation may not be the best choice for everybody. However. it can be a major benefit and provide some superb help for many student loan borrowers.

Every student loan borrower has that season when they are nearing graduation. And, the thought of paying back their student loans begins to start creeping into our thoughts and minds.

When trying find out what your options are one website tells you one thing and another one tells you something different, it can be difficult to know what is the best plan for your student loans.

This is why we have written this blog, hopefully it will assist you in determining if student loan consolidation is the right option for you.

Student Loan Consolidation

The term consolidation itself means to combine many loans in general into one single loan. This process generally also allows for a single interest rate and monthly payment.

Many people use consolidation to simplify their debt and position themselves better to pay down their debts much faster.

Student Loan Consolidation is not much different depending on what type of student loan is in question.

Federal student loans typically will not consolidate with other debts such as credit cards or auto loans etc.

Government student loans also will not consolidate with private student loans by means of a federal program.

Federal student loans are usually consolidated with other federal student loans that may be serviced by separate lenders

Private student loans because they can be more defined as a private signature loan for tuition payment however, can be consolidated with other debt in some cases.

Also private financial institution such as a bank will consolidate a private student loan and a federal student loan into one single loan.

However, consolidating federal student loans with private student loans will result in the loss of many federal benefits. These benefits can include programs such as deferment, forbearance, student loan forgiveness, fixed interest rates and repayment flexibility.

Professional assistance may be the best precaution when trying to figure out how you should go about consolidating your student loans if you have both federal and private loans.

Student Loan: Federal Consolidation

The federal government offers consolidation programs as a possible option for federal student loan borrowers. Not all federal student loans qualify for federal consolidation and federal student loan consolidation requires eligibility.

A Direct Loan Consolidation is the most common government consolidation program. This is because this type of consolidation is available for borrowers that are in grace period, repayment, deferment or forbearance.

However, individuals that are still in school will not qualify for a federal government student loan consolidation.

Get Your Free Loan Consolidation Consultation

833-782-7133

Federal Consolidation Benefits

Federal student loan consolidation

- One monthly payment: most federal student loan borrowers have more than 1 servicer. Having loans with multiple servicers means more than 1 monthly payment. Federal student loan consolidation will make it easy to make your payment.

- Interest rates: federal student loan consolidation will offer you a weighted average interest rate, this will remove all the individuals you have and you will have just one interest rate to follow with your single loan.

- Student loan forgiveness: the federal government offers loan forgiveness for individuals that qualify. A great percentage of public service employees or those in non-profit organizations are able to take advantage of this benefit. Even individuals that may not fall into any of these employment industries may have some options to student loan forgiveness.

- Alternative Repayment Options: You may have thousands of dollars in student loan debt and so your payments are hundreds or may be even thousands dollars as well. These payments may be unaffordable for you. Father than your loans going into delinquency or default, alternative repayment options may be just the blessing you need.

These plans can include:

Standard Repayment Plan – Payments are the same amount each month. This is on a 10 years term.

Graduated Repayment Plan – Payments start low and go up every few years, with the loan to be paid off in 10-30 years, depending on the amount you owe.

Extended Repayment Plan – Payments can be fixed or graduated, with the loan to be paid off over 12-25 years (available to those who owe more than $30,000).

Income Contingent Repayment Plan – Payments depend on your income, loan amount, and family size, and the loan must be paid off in 25 years (any remaining balance after 25 years can be forgiven).

Income Based Repayment Plan – Payment is capped at 15% of your disposable income and the loan must be paid off in 25 years.

This option is only available to those who can prove partial financial hardship. ( Any balance remaining after 25 years receive forgiveness).

What About A Parent Plus Loan?

Parent Plus loans are student loans taken out by the student’s parent or legal guardian. Parent Plus loans are not qualified for direct consolidation under the Federal Government

You can however consolidate a parent plus loan under options similar to a private student loan such as, consulting a bank or a financial lending institution

Is Consolidating My Student Loans the Best Thing For Me To Do?

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Truly we cannot decide for you, rather or not consolidating your student loans is the best option for you completely depends on your loans and your situation.

Like everything there are pros and cons to student loan consolidation.

Try to take these key components to remember while making your decision:

- Will the monthly payment be one that you can afford

- Will you have the option to deferment and forbearance programs if you need one

- Is there an option for student loan forgiveness

- What kind of interest rate offered (fixed or variable)

- Can you pay the loan off early

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

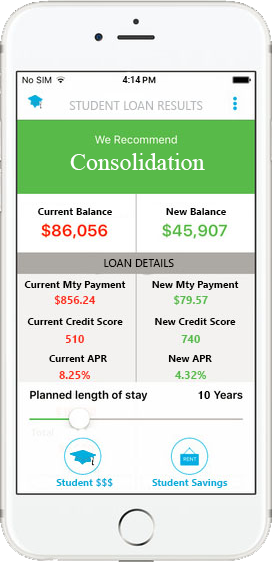

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments