DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Public Servant Loan Forgiveness

Daniel Morgan

Updated – June 7th 2024

About Public Servant Loan Forgiveness 2024

If you have student loans then you know the challenges that can come with trying to repay them back. Month after month, year after year making payments and the balance never seems to go down. Or try paying on a mortgage or rent and on top of that add in a student loan payment that is almost as much as your mortgage and rent payment.

For many households the student loan payments are the second highest financial obligation in the home. Falling just behind shelter expenses.

Sadly, for many of our nation’s finest and those we depend on the most in our society had to pay a hefty price for their education in order to receive the opportunity to serve us and our families each day as public servants to our communities.

Because of this the Public Servant Loan Forgiveness Program was created and put in place by lawmakers to help and provide support to those that work as public servants or for the federal government.

Who are these Public Servants?

- Police officers

- Park and Recreation Employees

- Community Health Workers

- State Social Workers

- Public Defenders and Attorneys

- School Bus Drivers

- Park Rangers

- City Employees

- Public Transportation Employees

- State Troopers

- Correction Officers

- Post Office Workers

Student Loan Forgiveness for Law Enforcement

WANT YOUR LOANS FORGIVEN?

CALL NOW

833-782-7133

How do I qualify as a Law Enforcement Agent?

Along with the understanding that you already have meet all of the other requirements, you will be able to receive student loan forgiveness for law enforcement if you work for the judicial system at any Local, State or Federal level. Borrower’s must enroll loans into a Direct Loan Program as well.

Furthermore, their loan must become a Direct Consolidation Loan. Borrowers will need to make 120 on time consecutive payments for 10 years. And, get student loan forgiveness after 10 years.

Here is a list to help you remember the basic qualifications for public student loan forgiveness for law enforcement.

2. Must make 120 consecutive on time payments within an income-driven repayment plan.

Note: payments before October 1st, 2007 will not count toward the 120 payments

Student Loan Forgiveness for Federal Employees

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Understand Qualifying Employment Expectations

Your specific job description is not bases on qualifying PSLF forgiveness. But, actually determined by the employer.

Employment with the following types of organizations qualifies for student loan forgiveness for public service.

Federal Government Agencies for all levels (federal, state, local and community)

Non-profit companies that are tax-exempt under 501c(3) of the Internal Revenue Service.

And, AmeriCorps or Peace Corps position also counts as qualifying employment for the PSLF Program.

Types of qualifying loans for Student Loan Forgiveness for Federal Employees

However, only qualifying payments that you make on the new Direct Consolidation Loan can be counted toward the 120 payments required for student loan forgiveness for public service.

Also, a completed public service loan forgiveness forms are required.

Important takeaways

You occupation and employer must qualify

Loan forgiveness for federal employees require 120 consecutive payments

A qualified payment is when your payment is on-time and in full

The term “law enforcement” does not just mean policemen. But anybody that works in the law enforcement field and employed by a government department

Hopefully our article has been informative and helpful in increasing your understanding about public servant loan forgiveness.

Other Related Articles

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

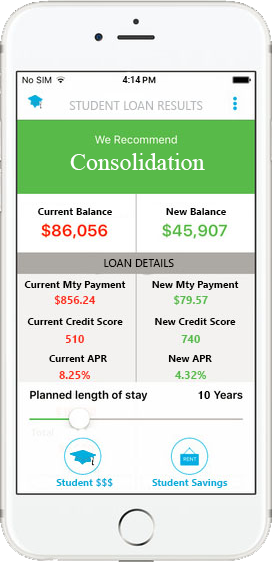

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments