DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Who To Talk To About Student Loan Help

Daniel Morgan

Updated – Jan 9th 2024

Over 40 million Americans currently have student loans and has student loan debt. For most of us paying back on our student loan debt is one of the most financially challenging issues we have today. And, many of us have little to no idea who to talk to about student loan help.

With an average student loan balance of $37,172 dollars, for most of us, our student loan payments are the second or third highest monthly obligation in the household.

The average monthly payment for a student loan debt borrower is approx $307.82 a month. Most students coming out of college have a hard time starting their careers with a competitive salary, because of this making their student loan payments can be a very difficult task.

For others the problem with their student loans may not be the monthly payments. Maybe your monthly payments are affordable but your interest rate is so high, you don’t see your loan balance decrease as you make your monthly payments.

This can be very discouraging for a borrower that want to see their loans get paid of as soon as possible.

Furthermore, some of us have become so bombarded with our student loan debt that the debt has become overwhelming. And the decision had to be made to just stop making your payments, and as a result the loan entered into default status.

As we can see there are many situations where we can find ourselves with when dealing with student loan debt. With so many laws, regulations, and lack of resources it can be very challenging for any regular person to know where to go, what to do or who to talk to for help with your student loans.

The best thing you can do as a student loan borrower that is in need of help, is to speak with a student loan professional.

When you speak your expert, there are some important topics you will want to be sure to add to the discussion.

In this article we will talk a little about some of those topics and hopefully help you get your most important questions answered accurately

Student Loan Forgiveness

Student loan forgiveness is definitely a subject you want to discuss with your student loan expert.

Student loan forgiveness is a program offered by the dept of education. Student loan borrowers either federal or private student loans. Federal student loans are eligible for student loan forgiveness but private student loans are not.

Not all federal student loan borrowers will qualify for student loan forgiveness. Only borrowers who meet certain requirements, possess certain loan types and are approved by the dept of education by their application process.

The types of student loans that qualify for student loan forgiveness are: federal subsidized and unsubsidized loans, federal Stafford loans, and direct loans.

The most common types of student loan forgiveness are as followed:

- Public Service Loan Forgiveness (PLSF)

- Teacher Loan Forgiveness

- Non-Profit Loan Forgiveness

- General Student Loan Forgiveness

- Disability Loan Forgiveness

Student loan forgiveness may be an option for you, so make sure you ask your student loan advisor about student loan forgiveness and to help determine if you are a good candidate for the student loan forgiveness program.

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

Repayment Plan Options

One of the most problematic things about student loan debt is having to repay back the money borrowed. If you are being required to make payments that are well outside of your valley of affordability, then a discussion about repayment options may be a very valuable conversation for you to have with your student loan consultant.

Most services will put you on a Standard Repayment Plan for your monthly payments. Typically, a standard repayment plan will require a payment equivalent to about 1 to 10% of your student loan balance.

However, there are alternative repayment plan options you qualify for. There are payment payments ideal for individuals suffering in a financial hardship.

There are income driven plans for individuals that need a payment that is more income focused. There are plans structured for individuals that has goals to get rid of the loan faster, allowing the payments to increase at a scheduled period.

Each of these repayment have certain criteria that a borrower must meet if they seek to obtain one of these repayment options

Make sure you discuss repayment plans with your student loan specialist.

Late, Delinquency and Default

One thing you will need to understand is “what happens if you do not make your student loan payments”

Late

If you find yourself late on your student loan payment don’t be to concerned about it. As long as you make your payment no more than 15 days after the payment date. With federal student loans a late payment usually will not have to much of a negative impact if you take care of it in a timely manner.

Delinquent

Now if you go delinquent on your student loan this may be a little bit more serious. A student loan becomes delinquent 30 days after the due date. If the borrower remains delinquent, the non payment will begin to be reported to the three credit bureaus and negatively affect your credit score and credit report. If the loan goes to long in a delinquent status the loan will move into a default status

Default

Student loan default is the worst stage a borrower’s loans can be status-ed due to non payment. A student loan goes into default after 271 days of no payment made.

- Wage garnishment: if you default on your student loan you become subject to wage garnishment. This is when a collection agency will request that your employer report your wages and take out penalty payments out of your wages,

- Tax offsets: this is where if you are due to receive a refund on your tax filing, the dept of education will report your defaulted balance and the irs will issue a tax refund intercept, taking the income from the refund as penalty for not paying the student loan.

- Credit Report: a default on your credit can cause major hindrances to your ability to use your credit in effective ways. Many people are declined for mortgages for purchasing a new home, others become ineligible for other loans to pay for other needs

Employment: default will disqualify you for many job or career opportunities. This can limit your income and ability to obtain employment with competitive salary options.

Once a student loan is in default terrible penalties are usually to accompany the loans.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Ok i’m ready to speak with a student loan consultant, Whats next?

So who can you to talk to about student loan help? Well we cannot tell you who to talk to about your student loan matters. But we do advise that you ask many questions, research and have a good idea of what you are looking to understand find out.

Use the information in this article to help as a guide for what topics you will need to know the most about.

There are some good student loan assistance companies and consultants out there, to learn more about getting connected to a student loan expert visit: www.fedloanpayment.org to find out who to talk to about student loan help.

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

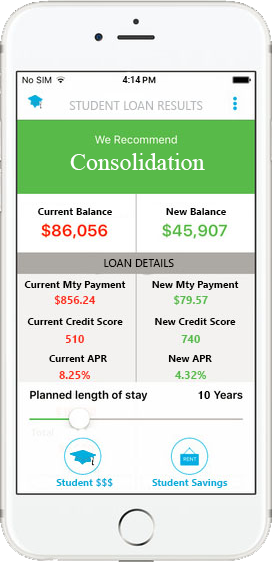

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments