DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2025

…I made the call and walked away with my loans forgiven!

You Should Call

Student Loan Forgiveness Application Backlog Is Growing, Not Shrinking

1. The Backlog Isn’t Getting Better—It’s Getting Worse

The backlog of applications for federal student loan forgiveness is ballooning—despite growing urgency and mounting frustration from borrowers. The Department of Education is still unable to make meaningful progress, leaving many applicants stuck in limbo.Forbes

2. What’s Causing the Pileup? Layers of Complexity and Conflict

The mess began with rapid policy shifts—courts halted programs like SAVE, forcing abrupt freezes on processing. These legal roadblocks, combined with sudden changes like program shutdowns, have thrown systems into disarray.Student Loan PlannerInvestopedia

Income-Driven Repayment (IDR) Processing: Over 1.5 million IDR applications are lingering unprocessed. A chunk of those are being denied outright because borrowers applied for blocked plans or defaulted to “lowest payment” options that are no longer available.Student Loan PlannerInvestopediaMarketWatch

PSLF Buyback Program: Those hoping to reclaim months of non-qualifying payments to qualify for Public Service Loan Forgiveness face growing delays. Backlogs have surged from around 49,000 to over 65,000 in just a couple of months.Student Loan PlannerInvestopedia

3. The Domino Effect: Complaints, Defaults, and Departures

The backlog ripples across the system:

Borrower Complaints: The Department of Education’s ombudsman and feedback offices are buried—handling tens of thousands of unresolved cases.Student Loan PlannerThe Times of India

Rising Defaults: As of mid-2025, 5.6 million borrowers were officially in default—and that number could near 10 million by year-end.Student Loan Planner

Staffing Shortfalls: Massive layoffs (~40–50%) at the Education Department and Federal Student Aid (FSA) have decimated institutional knowledge and slowed resolution times across the board.The Washington PostReutersThe New YorkerThe Times of India

4. Why This Matters—For Borrowers and the System

Borrowers are left scrambling, unsure if they’ll ever receive relief. For many, every month counts—and delays could mean mounting interest, missed deadlines, or even default. The system designed to offer options and relief is now a maze of chaos and delay.

Quick Summary Table

Issue | Status & Impact |

|---|---|

IDR Applications | 1.5 million pending; many denied—especially those tied to halted plans. |

PSLF Buyback Requests | Backlog soared to over 65,000, despite some processing. |

Borrower Complaints | Tens of thousands of unresolved cases clogging ombudsman and feedback channels. |

Defaults Rising | 5.6M borrowers currently in default; potentially close to 10M by end of year. |

Staff Cuts | Nearly half of FSA workforce slashed—crushing the department’s operational capacity. |

What Borrowers Can Do Right Now

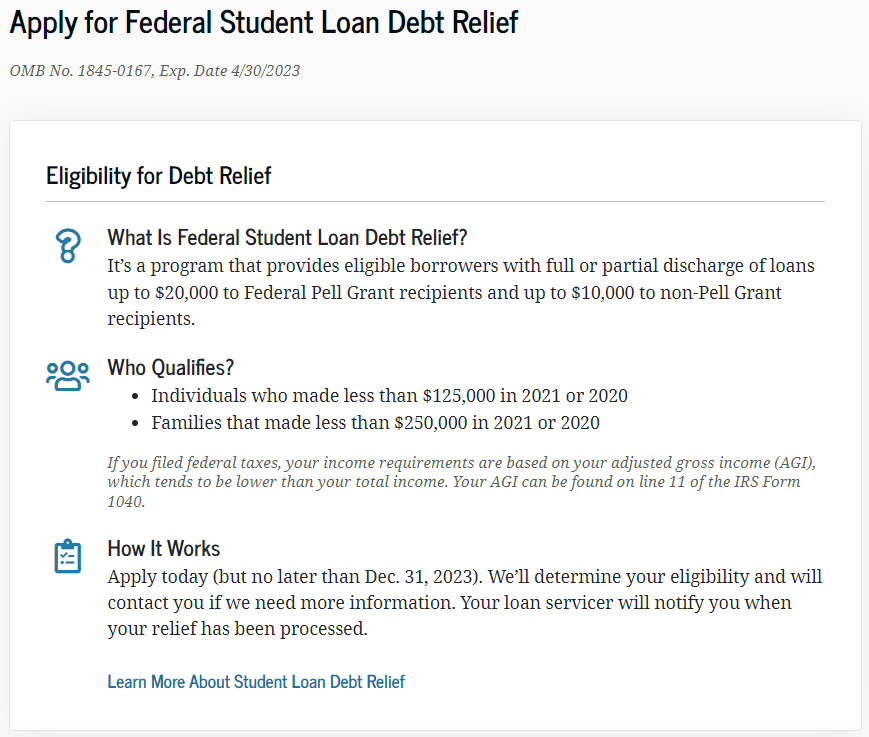

Reapply for IDR Plans: If denied due to blocked plans like SAVE, reapply for open options like IBR or PAYE using the online system with IRS data retrieval to speed things up.Student Loan Planner

Monitor PSLF Status: If pursuing PSLF especially via buyback, keep your application status in check. Delays are widespread—track carefully.

Reach Out to Representatives: Congressional offices often have dedicated casework teams. Filing a case with your representative may nudge stalled applications forward.

Consider Alternatives: If eligible for public service forgiveness, switching to a viable IDR plan may help ensure your payments count toward forgiveness while the backlog clears.