Government employee student loan forgiveness is exactly that in meaning, student loan forgiveness for individuals that

work for the US Government in any division, branch or level. For many this form of student loan forgiveness is known as

student loan forgiveness for public service.

Public Loan forgiveness for government employees is one of the best PSLF forgiveness programs available. This is

mainly because it does not matter what your title is, the fact that you are a public servant working for the Government is

the primary factor in your eligibility for a public service loan forgiveness program.

Student loan forgiveness for public service was a primary factor to address and modify for the Obama administration.

Commonly referred to as the “Obama Student Loan Forgiveness Program” or Obama Loan forgiveness” focused on providing

better student loan forgiveness options for public servants.

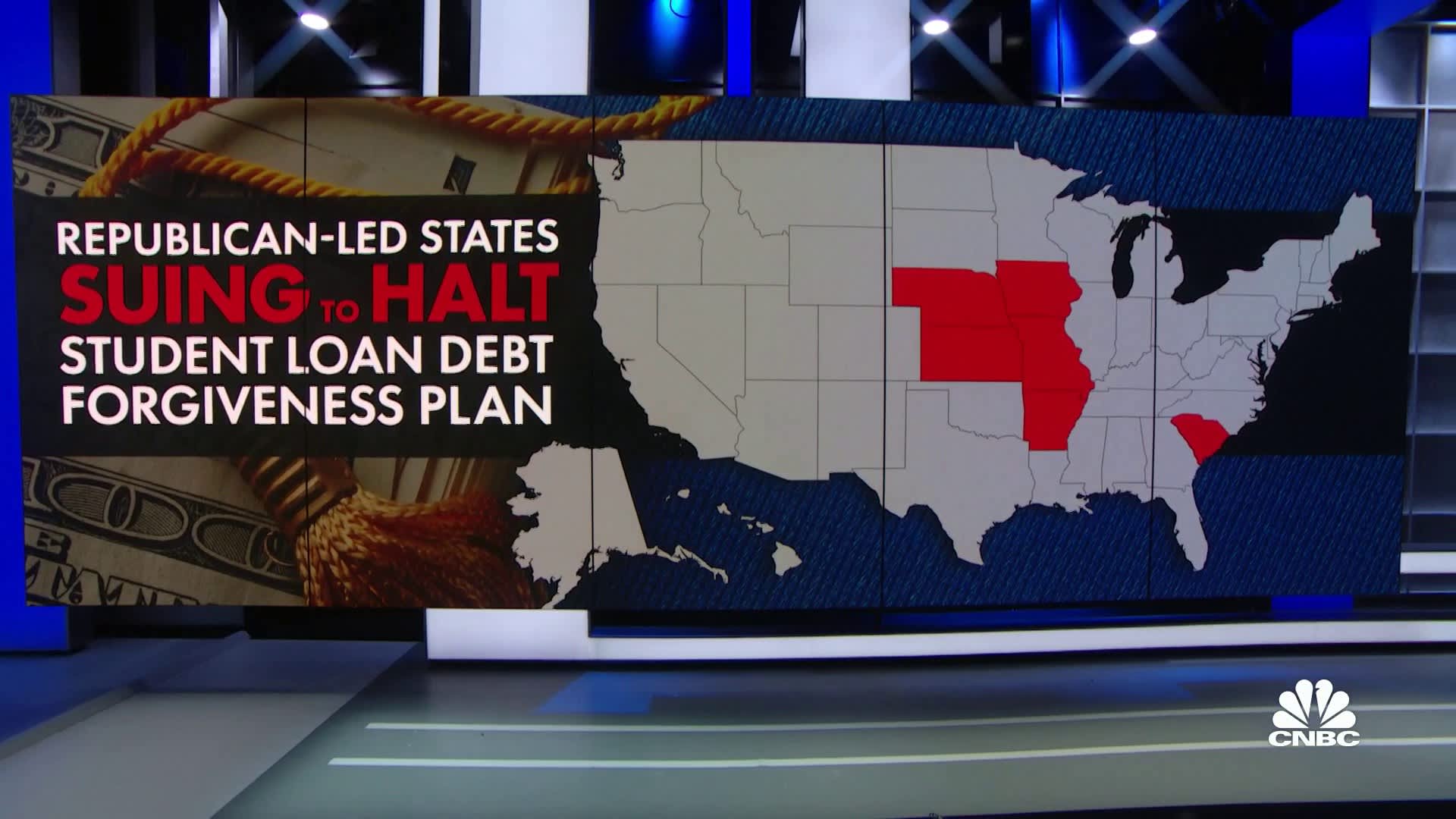

Now that president trump is in office, government employee student loan forgiveness along with student loan forgiveness

for public service may very well be under attack. And with the presidents new plans to reform the public loan forgiveness

program, we could see these programs diluted in effectiveness and benefits to those that qualify.

Public Loan Forgiveness Call To Action

It is strongly suggested and advise that those that feel like they may qualify to speak with a student loan professional now

being that we these programs may not be around much longer.

A student loan forgiveness for public Service advisor can help you determine the best option or route for you to take

to give you your best opportunity to partake in the advantages of government employee student loan forgiveness.

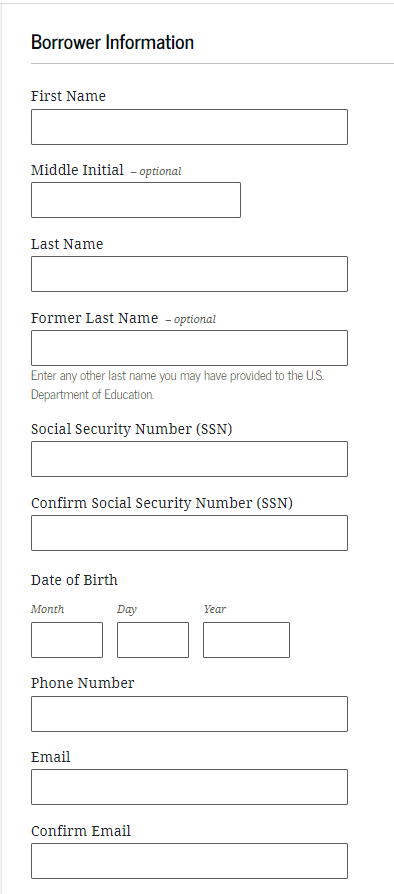

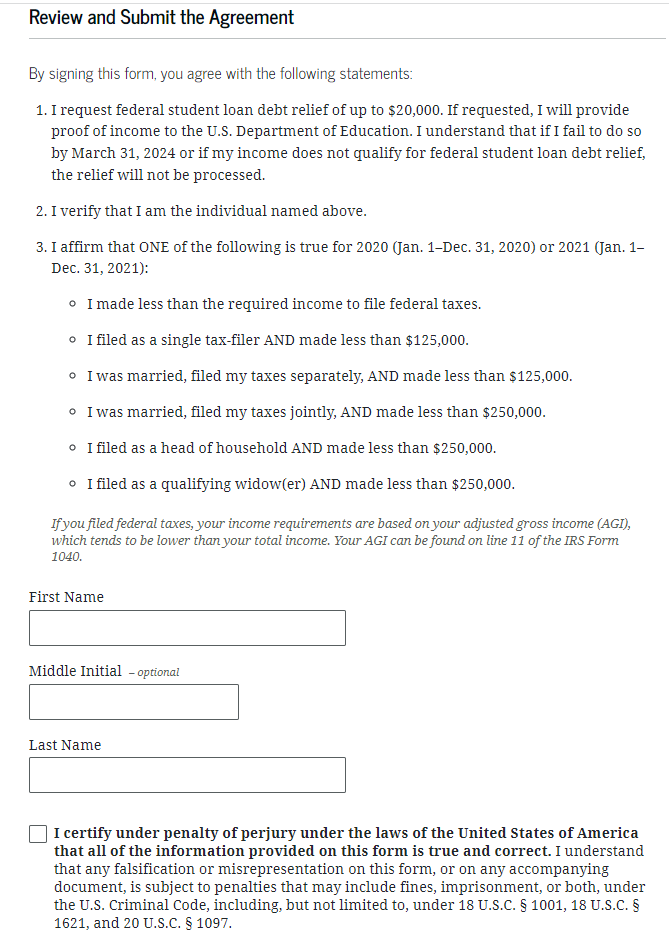

And provide assistance with all of the challenges with completing public service loan forgiveness forms and documents.

Public Servant Loan Forgiveness Tip

Be sure to discuss helpful programs like student loan forgiveness for nonprofit, student loan forgiveness for law

enforcement and, student loan forgiveness for federal employees. All of these will fall under public service loan

forgiveness, but will go a long way as far as gaining understanding of the public servant loan forgiveness program.

As well as, how to qualify for student loan forgiveness.

Government Employee Student Loan Forgiveness

Explained

So let’s explain how government employee student loan forgiveness works

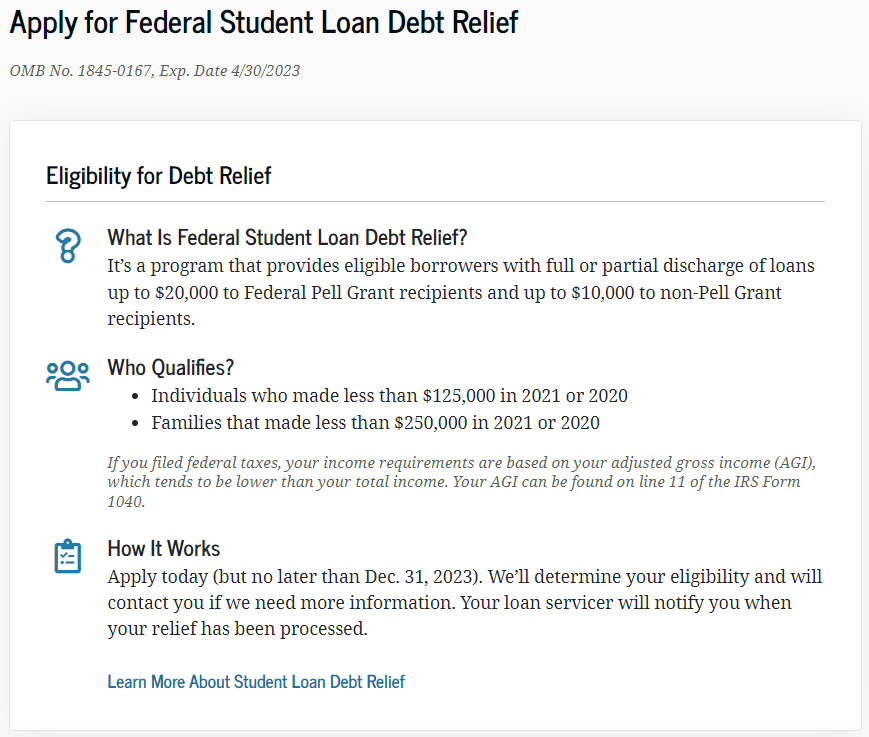

How to qualify for student loan forgiveness To begin with an individual must be employed by the Government.

You must work more than 30 or more total hours a week and/or be considered a full-time employee.

Of course assuming you meet all of the other qualifications and requirements, you will be able to obtain student

government employee student loan forgiveness if you work for the Local, State or Federal Government.

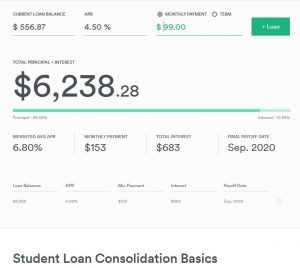

Your student loans will be need to be in Direct Loan Program as well or become a Direct Consolidation Loan. After

of which, you will need to make 120 on time consecutive payments for 10 years.

Public Service Loan Forgiveness Program Requirements

For individuals not considered as government employees or public servants qualifying for public loan forgiveness may not

be a realistic option. However those borrowers could possibly qualify for general student loan forgiveness, which will allow

a fasfa student loan borrower have their public student loan forgiveness after 240 to 300 months. Therefore, those eligible

for government employee student loan forgiveness should feel pretty grateful for student loan forgiveness after 10 years

rather than student loan forgiveness after 20 years.

Here is a simple list to help you remember the general requirements for student loan forgiveness for public service.

- Student loans must be under the Federal Direct Loan William D Ford Program and the loan(s) must not be in

- default status (what happens if you default on student loans)

- Must make 120 consecutive on time payments within an income-driven repayment plan. Note: payments before October 1st, 2007 will not count toward the 120 payments

- Must be actively working a full-time position in a qualifying public service position with a qualifying organization. All government employee positions qualify.

Public Servant Loan Forgiveness Cream of the Crop

Who has the best chance to be rewarded with such a great public service loan forgiveness program and benefits.

Anyone that has a Federal Direct Consolidation Loan and works for the Federal Government to some degree

( Corrections Officer, Policemen, Social Worker, Firefigher, Teacher, Recreation Park worker, state office worker, etc)

these programs will benefit greatly for.

- Student loan forgiveness for nonprofit

- Loan forgiveness for teachers

- Student loan forgiveness for law enforcement

- Student loan forgiveness for federal employees

Eligible Student Loan Types

Not all student loan types are qualified for government employee student loan forgiveness.

Private student loans are one important loan type that does not qualify for public service loans forgiveness.

Here for more information on Private Student Loan Options

Also

- FFEL Loans

- Perkins Loans

- Graduate Plus Loans

- Parent Plus Loans

All will not qualify for loan forgiveness for public service.

However, some of these loan types like FFEL for instance can become qualified if they are consolidated into

a Direct Consolidation Loan. Here for assistance with Student Loan Consolidation services.

What is a Qualified Payment

The most important thing is to ensure that each of your 120 monthly payments count toward your forgiveness.

There are three main factors:

- Your payment must be a full payment. partial payments will not qualify

- Your payment must be on a scheduled payment plan and program

- our payment must be an On-TIme payment. Late payments will not qualify

Just be sure to continue to work for the federal, state or local government. Make sure your payments are in full,

on-time and on schedule. By doing so, you should not have anything to be concerned about.

Also keep in mind that your monthly payment must be under an income-driven repayment plan in order for your

payments to be applied to your 120 payments for your forgiveness loan.

What Payment Plan Should I Have?

You must elect to enroll into an income-driven repayment plan. Professional assistance may be beneficial when

attempting to apply for an new student loan plan with new terms you are unfamiliar with.

So what plans are considered to be “Income-Driven”?

These five plans are all plans regarded as income-driven for federal student loans

- Income-Based Repayment Plan

- Pay As You Earn Repayment Plan

- Income-Contingent Repayment Plan

- Income-Sensitive Repayment Plan

These are the only repayments that contribute to government employee student loan forgiveness and student loan

forgiveness for public service. Your payments will not count toward any public loan forgiveness at all.

Tell Me More About What Jobs Best Qualify

The chance at public student loan forgiveness is ideal for all government workers. This includes all federal, state and

local government entities, organizations and agencies.

The main thing is to remain working full time and make the required 120 payments, after of which you will receive your

government employee student loan forgiveness and/or public servant loan forgiveness.

Here are some of the more common public service occupations for public service loan forgiveness or PSLF forgiveness

- Teachers

- Nurses

- Non-Profit

- AmeriCorp

- Peace Corp

Also it would be good to note that you do not have to perform all of your public services all at the same organization or even

the same position to stay eligible for your forgiveness.

You actually can mix it up, you can do a couple of years as a teacher, then serve as a guidance counselor and finish up your

last couple of years as a policemen and still get your loan forgiveness after 10 years.

Still need help? Or have more Questions?

You still may have questions about public service loan forgiveness programs or feel like you may need professional assistance

about how to qualify for student loan forgiveness.

Not a problem, we are here to help you. Who knows, you just might be able to get government employee student loan forgiveness.