DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Should I Consolidate Or Rehabilitate A Defaulted Federal Student Loan

Daniel Morgan

Updated – Jan 9th 2024

Consolidation or Rehab - Default Loans

The defaulting of a student loan can definitely have its disastrous impacts on a student. From dealing with collection agencies, tax offsets and suspension of driver license to wage garnishments and credit score dips, federal student loan default can be extremely stressful.

Should i consolidate or rehabilitate a defaulted federal student loan is a question many ask when attempting to over come a default student loan.

For those who have federal student loans, there are only two options for those trying to find a solution: Default Student Loan Consolidation or Student Loan Rehabilitation. Both of these options has positives and negatives, but either way they both have the potential to help you get back on track and out of default.

Now we will talk about some of the key things you will need to understand when dealing with defaulted student loans using student loan consolidation or student loan rehabilitation.

Default

First let’s make sure we know and understand what student loan default is and how it can impact you.

A federal student loan borrower is statused as in delinquency the day after a scheduled loan payment is missed. If the borrower makes the payment soon as possible or contacts their student loan servicer to discuss other options, a delinquency will not dramatically hurt a borrower’s student loan account standing.

But, the account will be statused as delinquent until the loan is made current, up until the borrower makes the necessary payment to bring the loan current. a delinquent student loan becomes serious 90 days after the initial missed payment, this is when the student loan reaches the point of being reported to the credit bureaus.

Once the loan goes 270 days without a payment the loan goes into default status, which means the loan is handed over to a selected collection agency, the borrower loses the right to qualify for a forbearance or deferment, and is subject to possible of wage garnishment, driver’s license suspension and tax offsets.

And to make matters worst, defaulted student loans are reported to all three of the major credit bureaus. Also, it could take years to rebuild a decent credit rating.

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

Consolidating Defaulted Student Loans

The first option we will discuss for a borrower with student loans in default is federal student loan consolidation. With Federal loan consolidation, the government will pay off the defaulted student loan for you, leaving you with a single, with one monthly payment and a fixed interest rate.

However if your student loan is already in a student loan wage garnishment,you will not be able to consolidate your student loans until the loans are out of the wage garnishment.

There are two ways to qualify for a consolidation on a defaulted student loan:

You can agree to go under an income-driven repayment plan or Make three consecutive monthly payments on your defaulted student loan prior to applying for consolidation.

If you choose to consolidate defaulted student loans under an income-driven repayment plan, you must choose one of the available income-driven repayment plans and provide proof of your income.

If you chose the three on-time payments option to qualify for consolidation, then you will have the option to choose your repayment plan that you are eligible for once the consolidation process has been completed.

Ideally, the consolidation of defaulted student loans process can take from 30 to 90 days to complete.

Once you have consolidated your defaulted student loan, collections agents may no longer contact you. However, your credit report will still include the information about your default for up to seven years, meaning rehabilitation is the better option for borrowers who are worried about their credit history.

Consolidated student loans are also eligible for benefits like deferment, forbearance, and loan forgiveness once the process is complete.

Generally, once you consolidate your student loans you cannot have your student loans consolidated again.

However, there are many cases where there is exceptions to this rule, be sure to seek professional help or consult with a student loan professional to discuss those possibilities if you believe you may need to consolidate your student loan a second or third time.

Still not sure now that we have talked a little about consolidation? Well, lets talk about the other half of your question, should i consolidate or rehabilitate a defaulted federal student loan?

Rehabilitating defaulted student loans

The other option for borrowers in default or facing defaulting of their federal student loans is student loan rehabilitation.

Student loan rehabilitation is a program offered to borrowers that will allow the removing of a default status after successfully completing the program after 9 months. If you have more than one student loan in default, you have to apply for rehabilitation separately for each loan, and only one defaulted loan can be rehabilitated at one time.

If you use rehabilitation for your defaulted student loans, you must make nine consecutive on time payments for nine months for the default status to be removed. In Addition, your payments under rehabilitation are expected to be reasonable based upon your financial situation.

Typically, student loan servicer will request your rehabilitation payments to be 15 to 25 percent of your discretionary income. If that is to much for you to afford, you can request that your lender recalculate the payment amount based on your documented income and expenses. Furthermore, borrowers that are in major financial hardship can even qualify to have their rehabilitation payments down to $5.

Once you have made all of the nine on time consecutive payments, your loan will be reported as rehabilitated. Then, the default is removed from your credit history. but the late payments will remain on your credit history.

However, understand that during student loan rehabilitation, you may still be subject to wage garnishment. Also, may still be contacted by collection agents.

With student loan rehabilitation you could face interest penalties up to 16 percent of unpaid principal balance. Also, accrued interest to the principal balance of the loan.

However, rehabilitation will restore your eligibility for benefits like deferment, forbearance, loan forgiveness, and a choice of repayment plans.

How to get my out of default

The stress that comes with the pitfalls of student loan default can be overwhelming. But there are options to help you get your student loans out of default.

You can try student loan consolidation or student loan rehabilitation, both can help in helping you get back on track and avoid more problems down road.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Take Away

Let’s take some key notes to remember if you are considering consolidation or rehabilitation of student loans.

There are only two options for default resolution (consolidation & Rehabilitation)

Default is when you go 270 days past due on your student loan payments

When you go into default your loans are transferred to a collection agency

You can not consolidate student loans that are in garnishment status

Rehabilitation usually takes 9 months to get you out of default status

Rehabilitation programs will require 15 to 25% of your income.

Student loan consolidation and rehabilitation or both very helpful ways to deal with default. Also, we suggest that you work with a professional to help you determine which option is best for you.

Should I Consolidate or Rehabilitate A Defaulted Federal Student Loan to get out of default is very possible. Also, can save you a world of problems and issues.

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

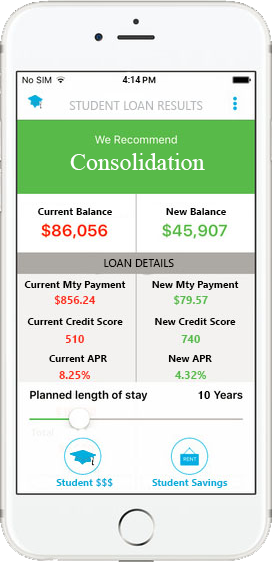

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments