DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2025

…I made the call and walked away with my loans forgiven!

You Should Call

Top Student Loan Mistakes to Avoid in 2025

Don’t Let a Simple Mistake Derail Your Finances

In 2025, navigating student loans is more complicated—and risky—than ever before. With policy rollbacks, new plans like RAP, and the repeal of SAVE, borrowers are making costly mistakes every single day.

Whether you’re new to repayment or have been managing loans for years, avoiding these top errors can save you thousands of dollars, protect your credit, and speed up forgiveness.

Let’s walk through the biggest federal student loan mistakes borrowers are making in 2025—and how to avoid them.

1. Assuming SAVE Still Exists

One of the most common and dangerous mistakes is assuming you’re still on the SAVE Plan. The reality?

✅ SAVE was repealed in early 2025 under the One Big Beautiful Bill (OBBB).

If you were on SAVE, you’ve now been automatically placed in the Repayment Assistance Plan (RAP) unless you proactively switched.

📌 Action Step: Check your current repayment plan at studentaid.gov to confirm where you stand.

2. Missing the Annual Recertification Deadline

Income-Driven Repayment (IDR) plans—including RAP, IBR, and PAYE—require annual income recertification.

Failure to do so results in:

A jump to the Standard Plan (higher payments)

Loss of progress toward forgiveness

Accrued interest capitalizing onto your principal

🗓️ In 2025, deadlines are stricter than ever—no more COVID-era extensions.

✅ Set reminders every 11 months and recertify early.

3. Failing to Re-certify for Public Service Loan Forgiveness (PSLF)

If you’re working toward PSLF, you must:

Submit the PSLF Employment Certification Form annually

Be on a qualifying IDR plan (RAP, IBR, PAYE—not ICR for most)

Work full-time for a qualified employer

🎯 Mistake: Not submitting proof of employment every year.

📌 PSLF Certification Form Link (Studentaid.gov)

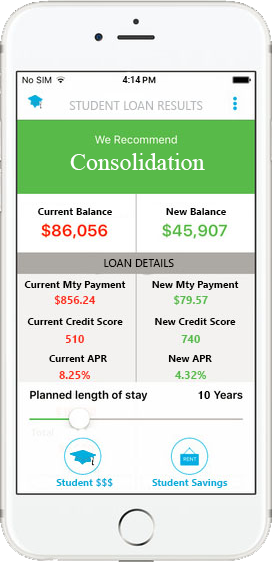

4. Not Consolidating FFEL or Perkins Loans

Many older borrowers still hold FFEL or Perkins Loans, which are not eligible for most modern relief programs, including:

IDR forgiveness

PSLF

RAP

Unless you consolidate them into a Direct Consolidation Loan, you’re locked out of key benefits.

📌 Direct Consolidation Application

5. Ignoring Your Loan Servicer’s Notices

It’s tempting to skip over emails or letters from MOHELA, Aidvantage, or Nelnet—but these updates could contain:

Payment due dates

Plan changes

Missed recertification warnings

Default notices

In 2025, more borrowers are entering delinquency and default just because they didn’t open their mail.

📌 Pro tip: Log into your servicer’s portal monthly. Set alerts.

6. Using Outdated Budgeting Strategies

The new RAP plan doesn’t cap unpaid interest like SAVE did. That means:

Your balance can grow again

Interest may compound more aggressively

You’ll end up paying more over time

🎯 If you’re budgeting based on last year’s rules, it’s time for a reset.

📌 Use the Student Loan Simulator to see real-time monthly payment estimates.

7. Believing Forgiveness Is Guaranteed

Many borrowers assume they’ll qualify for:

IDR forgiveness in 20–25 years

PSLF after 10 years

One-Time Account Adjustment

But forgiveness isn’t automatic and has strict eligibility requirements.

🛑 Common Mistake:

Skipping annual income certification

Being in the wrong repayment plan

Not working full-time at a qualifying employer

📌 Bookmark the Student Loan Forgiveness Center for ongoing updates and eligibility checklists.

8. Falling for “Forgiveness Fast” Scams

In 2025, TikTok and shady “debt relief” companies are preying on desperate borrowers with false promises of:

Instant loan forgiveness

One-time discharge programs

Guaranteed $0 payments

⚠️ These are often scams that charge fees for things you can do yourself for free.

✅ You never have to pay to apply for IDR or forgiveness.

📌 Report suspicious offers to: https://reportfraud.ftc.gov/

9. Overlooking Parent PLUS Loan Limitations

Parent PLUS loans have fewer relief options:

Not eligible for PSLF unless consolidated

Only IDR option is ICR, which has high payments and a 25-year term

🛑 Mistake: Not consolidating or thinking SAVE or RAP applies to Parent PLUS.

📌 Learn more: https://www.studentloan-gov.com/parent-plus-help

10. Not Asking for Help When You Need It

Student loan rules are constantly changing in 2025. If you’re confused, don’t go it alone.

✅ You can get free support:

From your loan servicer

Through nonprofit credit counselors

Ignoring problems leads to:

Late payments

Damaged credit

Loan default

📌 Take action early, even if your situation feels overwhelming.

Final Thoughts: A Little Awareness Goes a Long Way

In 2025, staying informed is your best financial defense. Student loans are more complex than ever, but with smart habits and up-to-date information, you can avoid disaster.

✅ Remember:

Check your repayment plan status regularly

Don’t assume you’re in the best option

Recertify your income on time

Be proactive—not reactive

Explore more guides, checklists, and tools at:

👉 www.studentloan-gov.com

Recent Comments