DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2025

…I made the call and walked away with my loans forgiven!

You Should Call

Will Student Loan Forgiveness Survive Beyond 2025?

A Year of Uncertainty for Borrowers

2025 has been one of the most turbulent years in student loan history. Between the repeal of the SAVE Plan, the launch of the Repayment Assistance Plan (RAP), and renewed legal battles over debt cancellation, borrowers are left asking the same question:

Will student loan forgiveness still be here after 2025?

The answer is complicated. Forgiveness programs like PSLF and IDR forgiveness are still in place—but political shifts and budget constraints mean nothing is guaranteed.

In this article, we’ll break down:

-

The current state of federal forgiveness programs

-

How politics and lawsuits could reshape them

-

What borrowers can do now to protect their progress toward forgiveness

1. Where Federal Forgiveness Stands in 2025

Despite the noise, several major forgiveness programs are still active:

-

Public Service Loan Forgiveness (PSLF) – Forgives remaining balance after 120 qualifying payments for eligible public service workers.

-

Income-Driven Repayment (IDR) Forgiveness – Forgives remaining balance after 20–25 years on an eligible IDR plan (now RAP, IBR, PAYE).

-

Teacher Loan Forgiveness – Offers $5,000–$17,500 for certain teachers after five years in a qualifying school.

📌 Full details: Federal Forgiveness Programs Overview

2. Why Forgiveness Is Under Pressure

There are three main threats to forgiveness beyond 2025:

A. Political Turnover

The 2024 elections shifted control of Congress, with key lawmakers openly critical of large-scale debt relief. Budget proposals for 2026 already include reduced allocations for forgiveness subsidies.

B. Lawsuits Against Forgiveness Policies

Multiple lawsuits are challenging both PSLF expansions and IDR reforms, arguing they exceed Department of Education authority.

Example: In early 2025, a coalition of states filed suit to block the One-Time Account Adjustment’s full implementation.

C. Cost Concerns

The Congressional Budget Office estimates forgiveness programs will cost over $550 billion in the next decade, creating pressure for reform or caps.

3. Changes Borrowers Have Already Seen in 2025

Borrowers have experienced major shifts:

-

SAVE Plan repeal – Removing the most generous interest subsidy in federal history.

-

RAP plan introduction – Payments based on 12% of discretionary income (higher than SAVE’s 10%).

-

Stricter PSLF employer verification – Annual submission is now mandatory, with real-time audits.

4. What Could Happen After 2025

Here’s what analysts and policy experts say might be next:

Scenario 1: Forgiveness Continues, but with Tighter Rules

-

Higher minimum payment requirements

-

Longer timelines for IDR forgiveness (e.g., 25 years minimum for all)

-

Caps on forgiven amounts (e.g., $50k max)

Scenario 2: Certain Programs Get Cut

-

Possible elimination of PSLF for new borrowers

-

Parent PLUS loans excluded from IDR forgiveness entirely

Scenario 3: Expanded Targeted Relief

-

More forgiveness for specific professions (healthcare, teaching, first responders)

-

Geographic incentives—loan relief tied to working in underserved regions

5. What Borrowers Should Do Right Now

If you’re aiming for forgiveness, take these steps before any policy changes:

✅ Verify Your Repayment Plan

Check if you’re on RAP, IBR, or PAYE and whether it qualifies for forgiveness.

✅ Submit Employment Certification

If pursuing PSLF, file your PSLF Form every year without fail.

✅ Track Your Forgiveness Progress

Download your payment history from your loan servicer’s portal.

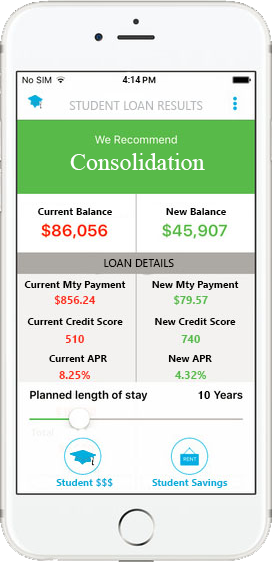

✅ Consolidate Non-Direct Loans

FFEL and Perkins loans must be consolidated into Direct Loans to count toward PSLF or IDR forgiveness.

📌 Guide: How to Protect Your Forgiveness Eligibility

6. Expert Predictions for 2026 and Beyond

Policy analysts suggest:

-

PSLF is likely to remain for current borrowers, but eligibility for future borrowers could tighten.

-

IDR forgiveness will continue, but with reduced interest subsidies and potentially higher payment calculations.

-

New targeted forgiveness programs may emerge—offering relief for priority workers rather than blanket policies.

7. Final Thoughts: Act While the Window Is Open

No matter where you stand politically, the reality is this:

Forgiveness programs are policies, not guarantees. They can change—or disappear—depending on leadership, budgets, and court rulings.

If you’re in a qualifying program now, lock in your eligibility:

-

File the right forms

-

Stay on qualifying repayment plans

-

Keep meticulous records

The future of forgiveness beyond 2025 is uncertain, but proactive borrowers can protect themselves from being left behind.

Recent Comments