DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

PRESIDENT BIDEN ANNOUNCES CANCEL OF 10K IN STUDENT LOAN DEBT FOR BORROWERS

Joe Biden’s Executive moves toward student loan relief and student loan forgiveness.

Daniel Morgan

Updated – Aug 24th 2024

President Joe Biden has plans for America's Student Loan Debt

President Biden on Wednesday reported he’s forgiving $10,000 in understudy obligation for Americans making under $125,000 every year.

The forgiveness of student loan debt was one of President Biden’s promises to voters, writing in March 2020 that his financial recuperation plan included “a quick wiping out of at least $10,000 of student loan obligation per borrower.” In late May, the Washington Post revealed that the organization was set to drop similar measure of obligation for Americans making under $150,000, yet the White House rejected that report at that point.

As per the subtleties of the arrangement delivered by the organization, borrowers should pay something like 5% of their optional pay month to month on undergrad credits, down from 10%, and will take care of their neglected month to month interest for however long they’re making installments. It will likewise excuse advance adjusts following 10 years of installment for those with totals of $12,000 or less, down from 20 years. While the singular cap is $125,000, families procuring under $250,000 will likewise be qualified. options was valid.

$10,000 forgiven and up to $20,000 if eligible

Moreover, Pell Grant beneficiaries making under $125,000 will be qualified for an extra $10,000 in forgiveness. Biden additionally declared he will broaden the ban on student loan payments through the year’s end. The payment pause was set to end Aug 31st 2022, but will now continue until January of 2023

As per an April report from the Federal Reserve Bank of New York, the “pardoning of $10,000 per borrower would excuse a sum of $321 billion of government understudy loans, kill the whole equilibrium for 11.8 million borrowers (31.1 percent), and drop 30.5 percent of credits delinquent or in default before the pandemic restraint.” However, implies testing in this style could wind up barring low-pay Americans who don’t document burdens yet have understudy loan obligation, as well as making expected issues with the Education Department lacking admittance to burden information.

Democratic Party Majority Leader May Disagree

The gradual wing of the Democratic Party, as well as Senate Majority Leader Chuck Schumer and Sen. Raphael Warnock, D-Ga. — who faces an intense re-appointment bid this fall — were among those pushing for Biden to pardon $50,000 per borrower.

All through the general population and confidential tension mission, the White House has promoted its endeavors to assist with educational loan obligation through its work with the Public Service Loan Forgiveness and the Income-Driven Repayment programs.

Unfortunately for individuals with private student loans. non of these possible opportunities for forgiveness will be an option. However New President Joe Biden, has mentioned taking steps toward adding private student loan debt to the list of dischargeable debt in bankruptcy laws.

WANT YOUR LOANS FORGIVEN?

CALL NOW

833-782-7133

How The Move Is Seen By Young Voters

The move is viewed as an endeavor to procure the help of youthful electors, with whom Biden saw his endorsement rating plunge recently, especially the individuals who are Black and Hispanic, as activity on issues like environment and maryjane authorization slowed down.

Numerous Democrats have encouraged the president to make a move on educational loans, calling it a moral and political commitment. Writing in the New York Times in April, Sen. Elizabeth Warren, D-Mass., said that understudy loan obligation abrogation was an issue that could end up being useful to Democrats in November

Up to $50,000 would be forgiven. By way of President Biden’s new plan, $10,000 of a borrowers student loan debt would be automatically canceled for each year one performs eligible service for five years total.

Covid-19 Student Loan Forbearance

Federal student loan forbearance first got approved in March. It was then extended on Mar, 2022. It was set to end Aug. 31st 2022, but President Biden upon inauguration extended the forbearance through Jan. 31st, 2023.

The forbearance also reduced all interest rates down to 0.0%. Allow individuals that would still like to make payments during the forbearance. To capitalize on 100% of their payments being applied to their principal balance.

Furthermore, this forbearance also prevents all default penalties and collection agency retaliation proceedings.

President of the NAACP With Strong Criticism

Derrick Johnson, president of the NAACP, has criticized the $10,000 proposal as “bad public policy and a devastating political mistake.”

“We are exhausted,” Johnson wrote in a commentary for CNN delivered on Wednesday. “The NAACP has been requiring at least $50,000 in educational loan obligation crossing out on the grounds that our exploration shows it is important to have a significant effect. The objective ought to be to see the most measure of alleviation for the biggest number of borrowers.”

Automatic Enrollment – All new and existing borrowers would be automatically enrolled in this new plan with the option to opt out.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Larger Tuition Grants

The most famous grant for most low income education seeks. is the Pell Grant. Currently this grant rewards up to $6,345, this handles less than 60% of most four year colleges. Based on talks, the Presidents plan would increase these amounts.

Additional Details

Repayment — borrowers will pay no more than 5% of their discretionary income monthly on undergraduate loans, down from 10%, and will have their unpaid monthly interest covered as long as they’re making payments.

Extended forgiveness – It will also forgive loan balances after 10 years of payment for those with balances of $12,000 or less, down from 20 years.

Low Income Families – Additionally, Pell Grant recipients making under $125,000 will be eligible for an additional $10,000 in forgiveness.

Important takeaways

President-elect Biden said federal student loan debt cancelation figures into his plan. “It’s holding people up,” he said about student loan debt. “They’re in real trouble. They’re having to make choices between paying their student loans and paying their rent, those kinds of decisions. It should be done immediately.” But he has not formally stated whether action will come from the executive branch or Congress. In December, he told a gathering of newspaper columnists it was “questionable” whether a president has the executive power to forgive $50,000 in federal student debt — a larger sum urged by several members of Congress.

Other Related Articles

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

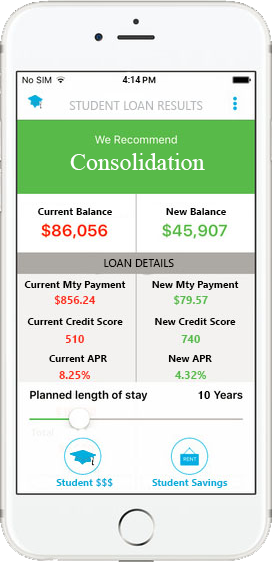

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments