DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Student Loan Forgiveness For Law Enforcement

Daniel Morgan

Updated – Jan 8th 2024

What Exactly is It?

Student loan forgiveness for law enforcement is a federally issued student loan forgiveness program available individuals in public law enforcement.

This includes:

- Police Officers

- State Troopers

- Probation Officers

- Federal Guards

- National Guards

- Public Safety Officials

- And more…

But, student loan forgiveness for Law Enforcement is not limited. Those in uniform are not the only beneficiaries. The program is more specific to whom you work for, more so than what your job title is.

In other words, let’s assume you are not a police officer, but you are the secretary to a detective. In this case you as secretary working for the police dept would qualify you as a person eligible for student loan forgiveness for law enforcement

Or in another example, let’s say you are a janitor in a county jail. At first glance most of us would look at job title janitor as one that would no chance whatsoever at a federal student loan forgiveness program.

However if this janitor was employed by the county he/she would in fact we an individual in position to take advantage of department of education student loan forgiveness.

How Do You Qualify for loan forgiveness for Law Enforcement?

Although qualifying for student loan forgiveness for law enforcement is not hard and at the very least is self explanatory. Still there are a few important requirements that police officers and other government employees will need to meet in order to fully become active in this student loan forgiveness program.

To start with a student loan borrower must work for atleast one division, branch, precinct or federal agency of law enforcement. In addition, a person needs to work a minimum of 30 hours or more a week and must be documented as a full-time employee.

Considering that you are established with all of the additional qualifications and requirements, you may be able to receive student loan forgiveness for law enforcement if you work for the Local, State or Federal Government.

So, what career you choose can be an determining factor on your student loans.

Do all Student Loans Qualify for Police Officer Loan Forgiveness Program?

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

No, all student loan types will not qualify for student loan forgiveness. If you are a policemen or law enforcement officer and have private student loans, then your loans would not qualify for loan forgiveness for students. Because of this some people will have no chance.

Only Federal student loans qualify for the public loan forgiveness. Private student loans, bank loans or any financial funding institution not federal will not qualify for this student forgiveness program.

So, make sure your loans are federal.

Other Loan Types That Does Not Qualify

- Federal Family Education Loan (FFEL) Program

- Federal Perkins Loan (Perkins Loan) Program

Eligibility Granted By Student Loan Consolidation

Now if you have private loans this option still is not a possibility for you unfortunately. Right now there currently still is no way to convert a private student loan into a federal loan. On the other hand, federal loans can be refinanced into a private loan.

But if you do happen to have federal loans such as a federal Perkins Loan or FFEL Loan you can make these loans eligible for student loan forgiveness for law enforcement by consolidating them into a direct loan consolidation program.

Only Direct Student Loans and Direct Consolidation Loans are eligible for the Public Service Loan Forgiveness program. Also, those loans include Federal Direct subsidized and unsubsidized loans and Federal Direct PLUS loans.

Perkins Loan Cancellation

This is a program specific to Perkins Loans.

This program will allow a borrower of a federal Perkins Loan to receive a percentage of student loan balance cancellation by the number of years of service up to 5 years. So, take a look below

Year number one is 15 percent

Also, year number two is 15 percent

Year number three is 20 percent

Also, year number four is 20 percent

And year number five is 30 percent

There are some important requirements and guidelines affiliated with the Perkins Loan Cancellation Program.

Here they are:

- sworn in as a law enforcement officers

- Are a person that general job duties are a direct contribution to criminal justice system

- Administrative task within law enforcement are not qualified

- Work in local, state, federal law enforcement, corrections agency or government funded facility

- Full-time law enforcement and corrections officers are eligible for 100% loan forgiveness under the Federal Perkins Loan Cancellation program for service that includes August 14, 2008 and after.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Do I Need to Make Monthly Payments?

Yes, making your monthly payments are essential to your success with student loan forgiveness for law enforcement. So, take special note of this section

The public service loan forgiveness program requires that an individual must make 120 consecutive monthly payments for 120 months. There are special conditions that apply to how you go about making these payments for the next 120 months in order to receive your student loan forgiveness after 10 years

*These are three most important guidelines that your monthly payments must abide by:

* Payments are to be made in full payment. Partial payments are not eligible

* Your payment must be on a scheduled payment plan and program

* Sent payments must be On-Time. Late payments will not qualify

Understand you will need to continue working for the police department, jail, prison or correctional facility for the full 120 months. Make sure your payments are in full, on-time and on schedule. Therefore, if you do this, you will be happy camper and should have no issues.

What Are the Qualifying Repayment Plans for Law Enforcement Forgiveness

Your monthly payment must be under an income-driven repayment plan in order for your payments to be applied to your 120 payments for your forgiveness loan. So, make sure you take to your counselor about these types of plans

Income-driven repayment plans are the only repayment plans that will allow your payments to go toward loan forgiveness after 10 years. Also, you can speak with a student loan consultant for assistance with enrollment through the Department of Education.

Professional assistance may be beneficial when attempting to apply for an new student loan plan with new terms you are unfamiliar with. Therefore, you do not have to try to accomplish all of this on your own

What are Income-Driven Payment Plans?

Below, list all Federal Government’s Income Driven Repayment plans.

Income-Based Repayment Plan

Pay As You Earn Repayment Plan

REPAYE Repayment Plan

Income-Contingent Repayment Plan

Income-Sensitive Repayment Plan

Those are the specific repayments that subject to student loan forgiveness for law enforcement and student loan forgiveness for public service. Payments will not count toward any public loan forgiveness at all, unless enrolled in an income repayment plan.

Important Keys to Keep for Student Loan Forgiveness for Law Enforcement

- Employed full time with a qualifying employer

- Any eligible federal student loan accounts are forgiven after 120 on-time qualifying payments Your monthly payments are not required to be consecutive

- By enrolling non qualified loans into a direct consolidation program, you can receive one convenient monthly payment

- On time payments include the full amount due and paid out no later than 15 days after due date

- Combine with Income-Based Repayment plan to significantly reduce your monthly payment

- Payments made during the forbearance, deferment, grace, or are in default status are not qualifying payments

Do You Qualify? Or Need Help Qualifying?

You may be a police officer, or an employee of the law enforcement and found this article to be helpful.

And now with a clear understanding of student loan forgiveness. but not sure how to go about finding out how to qualify for student loan forgiveness.

It may be wise for you to consult with a student loan forgiveness professional that can help you with the qualifying and public service loan forgiveness form application. .

In conclusion, attempting to do this on your own may have risk and leave you out of thousands of dollars that you could have had forgiven through the student loan forgiveness for law enforcement program

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

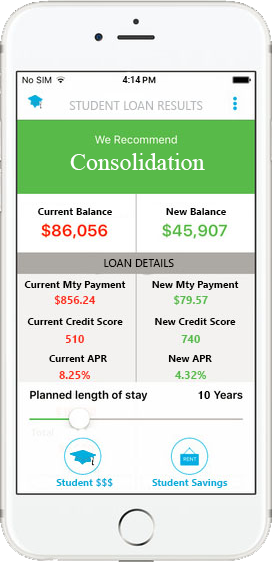

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments