DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2020

…I made the call and walked away with my loans forgiven!

You Should Call

Parent PLUS Loans & Refinance PLUS Loans

Daniel Morgan

Updated – Jan 9th 2020

So what is a Parent PLUS loan?

Parent PLUS loans are student loans taken out by a parent to help a child or grand child afford the cost of college attendance. Often, these type of loans will allow a parent or guardian to borrow the total amount or cost for the student’s college education. we are going dialogue on the topic of Parent PLUS Loans & Refinance PLUS Loans and what you can do about them.

Unfortunately, these Parent PLUS loans can come with a fairly high cost. Most Interest rates for Parent PLUS loans are very high, because of this more borrowers become more drawn toward refinancing the Parent PLUS loan at some point. Currently, Parent PLUS loans are 6.31% for loans disbursed on or after 7/1/16 and before 7/1/17.

However, there is light at the end of the tunnel, there are multiple options for refinancing Parent PLUS loans.

Let’s go ahead and take a look at a few of these options for borrowers seeking to refinance their Parent PLUS loans.

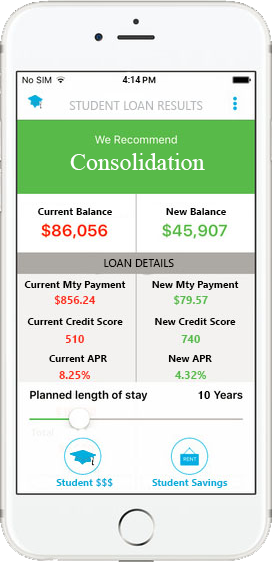

1. Consolidating Parent PLUS loans

The consolidating of your Parent PLUS loans can provide some great benefits. With that being said, the consolidating of your parent plus loans can also bring limitations to other benefits and you could lose out of benefits as well.

Consolidating a Parent PLUS loan can limit your repayment options. Borrowers that consolidate their Parent PLUS loans are ineligible for income driven repayment plans, these plans include (income based, income contingent, pay as you earn, and revised pay as you earn)

However exceptions can exist, for example: if a borrower has other federal student loans such as subsidized or unsubsidized stafford loans and they consolidate those loans together with their Parent PLUS loan, then the new loan will become eligible for income driven repayment options.

The loss of these repayment options can become a regret in the future if you at some point run into a financial hardship of some sort.

Borrowers that consolidate their Parent PLUS however are eligible for repayment plans such as the standard, graduated and extended graduated repayment plans.

Generally, these repayment plans are for 10 or 15 years in terms of repayment time period.

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

2. Refinancing Parent PLUS loans

You may be a parent that is already comfortable with the monthly and interest terms you have on your parent PLUS loan right now but, better conditions can always be obtained

The refinancing of a parent plus loan is usually done with a private lender or bank. Borrowers looking toward the refinancing option usually are seeking to get their student loan interest rates lowered.

Just as with parent plus loan consolidation, a credit check will be conducted.

The advantage of a parent refinance the loan instead of the student is that a parent usually has more employment history as well as credit history. Because of this a parent will be eligible for better and more attractive interest rates. Over time with a lower interest rate a parent borrower can save a great deal on interest paid.

For borrowers that don’t mind more or less losing most of their federal student loan rights and benefits, they would certainly benefit from looking into how to refinance Parent PLUS loans.

Still, be mindful that some of these federal rights and benefits include alternative repayment terms, forbearance, deferment and student loan forgiveness programs.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

3. Parent Refinance to the Student

Currently a small number of banks and lenders are allowing the child or student to refinance the Parent PLUS loan in their name.

Basically in this option the student completes an application to apply for a private loan. What makes it work is that a student can get approved for a lower interest rate on the private loan. Then use that money to pay off the Parent PLUS loan with its much higher interest rate.

However, credit is a factor with this method. A borrower will need to have good credit and a steady salary.

Generally, online lenders are the best to use with this option. Online lenders will allow the borrower to choose a payment that fits their budget. As well as, choose how long they would like the payment term to be. Usually terms are three to seven years.

The best part about this method is that the parent becomes completely free of the financial obligation of paying back the parent plus loan debt. Is the refinance of Student loans for parents for you?

Is the refinance of Student loans for parents the right option you?

Maybe, if you are not sure if Parent PLUS loan consolidation or refinancing Parent PLUS loans is right for you. Then, think about checking out all of your options. You just may be able to save more money on interest. Or, retain a lower monthly payment by making the decision to refinance Parent PLUS loans.

But i think we call can agree that less money on student student loans can mean more money for traveling, investments or retirement goals.

More available money to payoff other lingering credit hindering debts is always a plus. Refinancing your Parent PLUS loans maybe just the thing you need. now that you understand the Parent PLUS Loans & Refinance PLUS Loans process.

There is a Temporary 0% Interest Rate on Loans Owned by ED

From March 13, 2020, to the end of the COVID-19 emergency relief period, the interest rate on ED-owned student loans is automatically set at 0%. That means your student loans will not accrue (i.e., accumulate) interest during this time.

i just need to payoff my student loans and fast. all of this covid stuff is making it confusing

However, consolidation could also extend your repayment period (how long it takes you to pay off your loan). For example, consolidation could raise your repayment period from 10 years to 20 years. This longer period could increase the total interest you would pay over the life of your loan.

Not all federal loans have the same interest rate. The interest rate on a new Direct Consolidation Loan will be average based on your loan amounts and interest rates.

Your New Consolidation Loan Will Generally Have a New Interest Rate

The weighted interest rate is calculated using the interest rates for your loans and doesn’t take into account any interest rate reductions you may be receiving. After consolidating, your new interest rate is fixed (doesn’t change) for the life of the loan.

so federal student loan just let us parents out to die!!…

parents specailly singles ones like me cannot make these student loan payments. The DOE and federal govt better put a package for these federal student loans. the Cares Act has been a help. making student loans stop for a while.

Parent PLUS Loans & Refinance PLUS Loans is by FAFSA federal student aid. does those kind get loan forgiveness? atleast an income based repayment plan or something.

i needs some serious understand about Parent PLUS Loans & Refinance PLUS Loans. im not sure what to do, i definitely need processional student loan help

My son got these loans, but i am getting billed for them. so would that mean they gave me parent plus loans?

My wife and i felt quite delighted to fine this information on parent plus loans, so i had to write this comment as a thank you.

what is the best way to get out of a parent plus student loan? and will refinancing the plus loan help at all?

If some one needs a parent plus loan is your credit checked for approval? also do parent plus loans have high interest rates then a regular stafford student loan?

GOV Student Loan Service is the best company for any student loan issue. I definitely recommend them

i hate dealing with these student loans, there is so little help with private loans and parent plus loans…smh

i went in to default on my parent plus loan. i call a company named navient the 1st time to get help with them because the payments were over $900 they where the people billing me. anyway they would not help me. basically wanting me to pay the same thing. So i called this company here GOV student loan service, they actually gave me real help. got my payment lowered to $157 a month.

I want help with my student loans and parent plus loans

my sons student loan payment is almost 500 a month, how is me suppose to pay that????

are parent plus loans the only options for parents to help students with payment

you can help get help with your student loans

student loans are not just parent plus loans, or private student loans

My husband and i ended up being very thrilled Chris managed to finish up his investigation with the ideas he gained from your web page. It’s not at all simplistic to just find yourself giving Thank you for everything!

my student aid is not available right now for some reason. how do i get it back going so that i can qualify for a parent plus student loan?

Spot on with this write-up, I honestly think this amazing

site needs a great deal more attention. I’ll probably be

back again to read more, thanks for the info!

Asking questions are genuinely pleasant thing if you are

not understanding something entirely, parent plus student loans have been a problem for many parents trying to pay for there child’s education

Thank you a lot for giving everyone an extraordinarily spectacular possiblity to discover important secrets from this site. It’s always very cool and packed with a lot of fun for me and my office co-workers to visit your website a minimum of 3 times in one week to study the newest issues you will have. And indeed, I’m so at all times fascinated with your incredible ideas you serve. Some 3 points in this post are in reality the finest we’ve ever had.

I have been browsing on-line more than three hours nowadays, but I never found any fascinating article about parent plus loans and refinancing plus loans.

thanks for your service, will be letting my co works know so they can call and get the program too

My husband and i were trying to find out what to do about the student loans we took out for my daughter. We heard about refinancing student loans but was not sure about doing it. we called this company to learn more about it. the advisor practically did everything for us, it was a good deal. Thank you for the whole thing!

so can i have my son pay for these student loans? there where for him anyway…i need help with this

Jordan,

If the student loans are in your name, you will solely be responsible for the repayment of the loans.

thank you for your help! James was great and we where able to get my student loans handled.

These parent loans are the worst! thanks for the student loan forgiveness program yal put me on.

I dont want to work with any of the big companies for my student loans. i want to consolidate them, so i will be calling in today to start the process.

i have been paying on my parent loans for over 15 years and seems like nothing has happened to the balance, before reading this article i though i would die trying to pay this off. i will be reaching out to https://www.studentloan-gov.com for student loan help

I am perpetually thought about this, thanks for putting up.

i will be consolidating my student loans today

i was told to refinance my student loans, but i was interested in consolidating them. can you tell me which is the best way to go for my student loan payments?

A way to help others is by giving them extra hand

SO gov student loan service can help me find out my options for my parent plus loans. i have been dealing with them for a long time now and would like to get rid of them asap

after reading this i understand that this could help my credit and help me repay my student loans better

My spouse and I stumbled over here coming from a

different page and thought I may as well check things

out. I like what I see so now i’m following you. Look forward to exploring your web page for a second time.

I am a mom with parent plus loans for two of my daughters, does that matter with getting my student loans refinanced or consolidated?

this website studentloan-gov.com has been a life saver, i filled out the contact form and a student loan helper answered and helped me with my student loan issues. i got my student loans in order now

I have 10 student loans 3 of them are parent loans. can i have them put into one student loan? If so do i just call the number on the website to get started?

Hello Maria,

We can go over your options with you. Yes Just call the number above and we will help you with everything.

Your style is really unique in comparison to other people

I’ve read stuff from. Many thanks for posting when you’ve got the opportunity, Guess I will just book mark this site.

Hi there mates, fastidious piece of writing and fastidious arguments commented at this place, I

am genuinely enjoying by these about student loan grants

Hello, I enjoy reading through your article post on parent plus loans and refinancing plus loans.

I wanted to write a little comment to support you.

It is not my first time to pay a visit this website, i

learn more about my student loans and Parent PLUS Loans & Refinance PLUS Loans from here everyday.

hard to get usful information about student loans and how to get help with them. i will be calling you guys today to get help with my student loans for sure!

Fascinating blog! Parent PLUS Loans & Refinance PLUS Loans

Bless you

Once I originally commented I clicked the -Parent PLUS Loans & Refinance PLUS Loans- checkbox and now each time a remark is added I get four emails with the same comment. Is there any means you possibly can help me with your service service? Thanks!

Parent PLUS Loans & Refinance PLUS Loans great to hear we have options as parents

I enjoy the report

i want to consolidate my student loans. im going to check out the article on that too

if i have a parent loan and some other loans i can still get them in one loan…awesome!

Thank you gov student loan service

great read, i needed this info for my clients, i will have them call in to speak with a rep

i need help my plus loans but there are very old. wonder how the programs work with that.

Keep up the great work guyz.

This site is absolutely fabulous!

Your site is so fantastic. I’m going to come back here again.

i took out loans for my daughter, how they want me to pay and not her. how do i make it so that she pays for the loans and not me since they where for her schooling?

unfortunately Pedro, that is not possible. parent loans are in fact the parent or guardians responsibility even though the you are not the student.

Can my parent plus loan be forgiven?

i have some parent loans that i have had for 9 years, i pay on them but the balance seems to not move. what can i do about this? please help

great information for parents with kids education they are paying for. i will be forwarding this website and article to my friends

what if you make alot of money? can you still get help with your student loans as a parent?

best article and more informative on the subject that i have ever came across. now i can tell me my mom about what she can do with my loans

Your so cool! I dont suppose Ive read anything such as this before. So good to get somebody with some original thoughts on this topic. really we appreciate you starting this up. this fabulous internet site are some items that is required on the internet, somebody with slightly originality. beneficial function for bringing a new challenge on the world

Hello to all, it’s actually a pleasant for me to visit this website, it consists of useful Information.