DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2020

…I made the call and walked away with my loans forgiven!

You Should Call

Refinance Without A Degree

Daniel Morgan

Updated – Jan 5th 2020

We all have goals in live, many of us the goal of going to college, get our degree and move on to the career of our dreams. Our desired hope is that by getting a degree we will be rewarded with better job opportunities and better wages. However, secondary education can be very expensive. With work, family and many other responsibilities dropping out and sometimes become the only option. Refinance Without A Degree will be at the core of our topic in this article.

We all have goals in live, many of us the goal of going to college, get our degree and move on to the career of our dreams. Our desired hope is that by getting a degree we will be rewarded with better job opportunities and better wages.

However, secondary education can be very expensive. With work, family and many other responsibilities dropping out and sometimes become the only option. Refinance Without A Degree will be at the core of our topic in this article.

Unfortunately, those who are forced to drop out for whatever the reason will still be required to make payments on their student loan debt.

Refinancing your student loans can help in this situation, but a refinance without a degree can be pretty canny

No Degree Refinancing

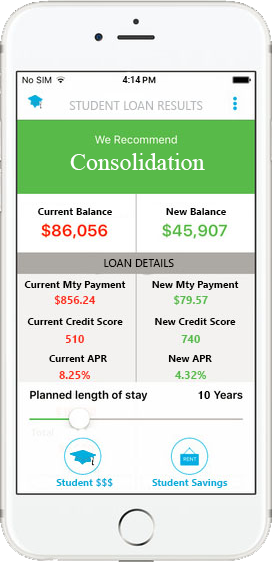

Refinancing your student loans can make student loan debt much more manageable. Student refinancing can help with interest rates, alternative repayment options and possibly the lowering of your monthly payments. With all these benefits together, you may be able to free up more of your income to better budge. And a less stress on your financial responsibilities

Private Student Loan Refinancing

When it comes to refinancing private student loans without a degree challenges will present themselves. Most lenders for private and/or federal student loans that you look to refinance with a private lender like a bank usually require completion of your degree program to be qualified for refinancing of your student loans.

However, still are some lenders that will refinance a loan of a borrower that did not graduate. Typically, a person that qualifies for this may have a different application process to complete

Student Loan refinancing with a federal program

Unlike attempting to refinance a student loan through a private lender, refinancing through a federal program is much more forgiving. People that refinance their loans with the federal government are not approved or rejected for the student loan refinance based on if they graduated, received their degree, did not graduate or did not receive their degree. So, refinance without a degree on federal terms is a better situation.

Private student loans are not eligible for federal student loan refinancing programs.

For a person that did not graduate but is stuck with the obligation of repayment of their student loans. Federal student loan refinancing may be a primary option if they have federal student loans.

Based on studies, non graduates have a more difficult time meeting the minimum payment initially issued by their servicer. This could be due to low income, unemployment or other factors. Federal student loan refinancing can help such a person with alternative repayment options, deferment programs, forbearance. And plans based on income.

Many non graduates finds these programs very beneficial during difficult times.

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

Repayment Programs (Income Driven)

If you have federal student loans, you will usually enter a standard 180 month repayment 6 months after you leave school, whether you graduated or dropped out early. However, if your payments are too large for you to handle, you may be eligible for an income-driven repayment plan.

Income-driven repayment plans:

- income-based repayment

- income-contingent repayment

- Pay As You Earn

- Revised Pay As You Earn

With each of these options your monthly loan payment is capped at a percentage of your discretionary income, and your repayment term is extended. That can dramatically reduce your payments, freeing up more money in your budget for your essentials.

Forbearance

- Forbearance is a option that will allow you to pause or postpone your payment for 30 days, 60 days 90 days and up to 12 months.Many people get deferment and forbearance mixed up. When your student loans are in forbearance, your loans will accumulate interest during this time. You can qualify for forbearance if your payments total more than a certain percent of your gross income. Or, if you are suffering a financial hardship, or fighting with sickness or serious health issues.

Deferment

Deferment gives a borrower the ability to stop their student loan payments for up to a full year at a time. Usually, a borrower is reward up to 4 deferments. Generally a person would seek to apply for a deferment if they are unemployed and does not see employment coming in the foreseeable future. And, or experiencing severe financial hardship seemingly for an extended period of time. Moreover, in some cases depending on your student loan type, the federal government may cover your interest on the payments for you.

Handing your student loans with no degree

If you are a student that withdrew from your degree program or dropped out for reasons important to you and your family. Do your research to find out what you can qualify for. Refinancing your student loans may be a viable option for you. Presenting the possibility of more attractive interest rates, alternative income sensitive repayment options. And payment stopping options like forbearance or deferments.

Refinance without A degree is a possibility for sure, you just have to fine what situation is best for you.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

i was told by federal student loans that Past payments made on loans before consolidation count, even if on the wrong repayment plan. is that true? i sure hope so

so navient is going to become Aidvantage. everything is changing, my degree isnt going to matter anyway

This came directly from the horses mouth people. Navient will transfer its federal student loans owned by the U.S. Department of Education to Aidvantage. This change will not affect the existing terms, conditions, interest rates, loan discharge or forgiveness programs, or available repayment plans on the loans. It also will not change the temporary payment suspension and 0% interest benefits borrowers are currently receiving due to the coronavirus emergency.

Look out for notices from us, Navient, and Aidvantage for information about these transfers. Be sure to read all of these notices fully.

I heard this was the best place to consolidate my federal student loans. i hope so because my student loan repayment is crazy high

i did graduate now i have like 16 student loans. i know Covid is suppose to help right, right right??????

what is wrong with our govt…bro why wont they just wipe out all of the damn student loans already! After Covid they should know by now

if i consolidate my student loans will i still be able to get the Covid-19 0% interest deal?

Yes

Your Income-Driven?Repayment?(IDR)?Recertification Date Has Changed

You will not have to recertify your income before the end of the COVID-19 emergency relief period, regardless of whether your recertification date would have happened prior to the end of the relief period. As part of the payment suspension, your recertification date has been pushed out from your original recertification date.

i have so much student loan debt and no degree, i need help

Refinance Without A Degree is possible. student loan consolidation is a good option as well. there are IBR repayment plans, options for a lower monthly payment. federal student aid. all fo that

This is a message to the Can I Refinance Without A Degree? – Help for Non Grads In Student Debt…i dont have a degree need help with my student loans

great article and website for student loan help.

Nice blog! refinance without a degree blog really jumps out. Please let me know how to contact one of your student loan agents to get help for myself. Thanks

Hey there! so i can refiance without a degree. i thought you have to complete school to get help with the loans. thanks GOV Student Loan Service

I spent a great deal of time to find something such as

this.

It works very well for me

so i can refinance but consolidation is better and if i go back to school i can add loans to my consolidation

This excellent webste really has all the information and facts I needed concerning this subject ?nd didn’t know who to

ask.

i need to speak with someone becuase my loans are jacked up and i did not finish my school program. i heard consolidation is better

Hello, you just read the article and hopefully get some advice or later. I have an 8-month-old baby product of a relationship with a married man, when I was 8 months pregnant and obtube my disability in my work I came to each of my parents to end my pregnancy here, my daughter’s father sends her pension sometimes not every week for expenses or setbacks that are presented but always to be aware of it, and my parents every quinsena if they can buy a bottle of milk and diapers, I stopped working to see and take care of my baby and his Dad and I came to the agreement that he would be doing it every month and I would take it every month since we live in different cities but I could not do it because they do not let me go and take it. His paternal grandparents do not even know her because anything that talk about my daughter’s father is forbidden and I really feel very desperate because they are lawsuits with him and with them and the truth is I’m looking for ways to get out of my house and was independent and I feel that my biggest mistake was not return at work, hopefully and you can give me advice. A desperate single mother

best article on this subject i have read. Most of us students dont get this info from our schools or financial offices. Thank you for this information. I will tell my friends to contact you guys for their student loans.

John Holleman

if i refinance my student loans can i still go back to school and get more financial aid?

Hi Julie,

Yes you can. We can answer all your student loans questions, as well as help you with the process.

give us a call. you can reach us at 833-782-7133

talk to you soon!

wonderful site. very useful info

Keep all the articles coming. I love reading through your things. Cheers.

i am calling you guys today…thank you so much. good information about student loans is hard to find.

I could not finish my degree becuase i got pregnant. but i still have a ton of money i owe for my student loans. I dont know if refinancing will help me or not. I also heard that consolidation can help me too. I will be reaching today. thank you

Thanks to my father who told me on the topic of

this blog, this weblog is genuinely remarkable.

suit true to dimensions.and that i am glad I did. These are terrific for do the job

Hi,I check your blogs named “Can I Refinance Without A Degree? – Help for Non Grads In Student Debt” daily.Your humoristic style is awesome, keep it up! i plan on sharing this info with my friend that has student loans