DO YOU QUALIFY FOR STUDENT LOAN FORGIVENESS?

2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

Student Loan Forgiveness For Federal Employees

Daniel Morgan

Updated – Jan 7th 2024

Are you a government employee or considering working for the federal government? In 2024, careers in public service has become one of the most popular trends of young adults. As well as, new graduates coming out of college in recent years. Student Loan Forgiveness for Federal Employees has become a hot topic.

One reason is because of the benefits that comes with working as a federal employee for our government. As a result, at the top of the list of these benefits is student loan forgiveness for Federal employees.

Student Loan Forgiveness for federal employees is more well known as Public Service Loan Forgiveness or PSLF. Jobs in federal government is the focus. Including any level of State, Federal or local Government.

If you find yourself in any of these categories, consider yourself the best candidate for this student loan forgiveness program.

Student loan forgiveness for public service if one of, if not the best student loan forgiveness program on the market.

In 2023 then previous years, changes in student forgiveness during the Biden Administration has made PSLF forgiveness an easy qualify.

Student Loan Forgiveness for Public Service & Government Employees

If you or anyone is an employee of the federal government while working full-time hours. And your job duties fulfill those of the employment task required by the Department of Education. You will qualify for public student loan forgiveness.

Simply put, a federal student loan borrower may be able to receive student loan forgiveness for government staff by staying employed. That is, with the federal government, state government or local government for ten years minimum.

This in recent times is considered as the most cost effective, quickest and best possible way of how to get out of paying student loans, aside from student loan discharge by way of the Borrower’s Defense Against Repayment Program.

For the skeptical about the ten year forgiveness program. Understand that general public loan forgiveness does not provide forgiveness until after 20 years.

We assume most would consider student loan forgiveness after 10 years easily over student loan forgiveness after 20 years. Therefore, saving on ten years of paying on student loans could end up being enough money. Over time maybe enough to send children off to college in time.

Qualified Loan Types For Government Employee Forgiveness

Of course not all student loans qualify for the best student loan forgiveness program in the country.

The student loan types that do qualify are as follows:

Federal Subsidized Loans

Direct Subsidized Stafford Loans

Direct Unsubsidized Stafford Loans

Federal Unsubsidized Loans

Direct Consolidation Loans

A borrower’s loans must have been awarded and issued under the Federal William D. Ford Program to be qualified for PSLF forgiveness. Any other loans will not qualify

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

Loan types that don’t qualify

Unqualified loans are private student loans. As a matter of fact, a private student loan will not qualify for any federal student loan forgiveness program. Including benefits or assistance.

Federal and private student loans are acquired the same way. However, private loans do not provide the same protection and rights that federal funding supplies.

Other student loans that does not qualify for student loan forgiveness for federal employees are:

- Family Federal Education loans or (FFEL)

- Federal Perkins Loans

- Grad Plus Loans

- Parent Plus Loans

Even though these loan types alone do not qualify for student loan forgiveness for public service. However, they can become eligible by consolidating them in a Direct Consolidation Loan Program.

Repayment Plan Qualifying Requirements

Now not just any payment plan or payment amount will suffice for getting loan forgiveness after 10 years by way of the public service loan forgiveness program. Therefore, only specific repayment plans will qualify you for this loan forgiveness program

Which Repayment Plans Qualify?

Income-Driven, Income-Based Repayment plan enrollments are required. These plans were created and established by the federal government in order to help fasfa borrowers suffering from temporary financial struggles.

Here is the list of qualifying repayment plans you will need to elect to enroll in to qualify

- (IBR) or Income-Based Repayment Plan

- (ICR) or Income Contingent Repayment Plan

- (ISR) or Income Sensitive Repayment Plan

- (PAYE) or Pay As You Earn Repayment Plan

- (REPAYE) or Revised Pay As You Earn Plan

Again only these repayment plans will contribute to the student loan forgiveness for federal employees program and benefits. Neither of the other repayment options besides those listed above will count monthly payments to your student loan forgiveness program.

Don’t make the common misfortune of waiting to get help with enrollment into one of these repayment plans. Therefore, the sooner you enroll, the sooner you can start making payments that will contribute to your student loan forgiveness after 10 years.

Qualified Payment Guidelines

Delivering your payments are ON TIME

Make sure your payments are IN FULL

Making sure your payments are SCHEDULED

These three we have determined to be pivotal for success and whether or not your monthly payments will even be applied to your loans for the purposes of getting student loan forgiveness for federal employees on them

.

You must make 120 monthly payments for 120 months. The good news however is that your payments do not need to be consecutive. You can use deferments and forbearance’s as needed and then continue where you left off after your temporary payment postponing is over.

With that you can take confidence in knowing that you will be on a study path of success so long as you remain working for the state, federal or local government whiling making your payments on-time, in full or course and whiling being on a qualified repayment plan with a scheduled system.

Understanding Employment Expectations

With student loan forgiveness for federal employees, employment requirements are probably the easiest requirements to meet in order to become eligible. This may be one reason if you are not already employed with the federal government, you may want to become employed by them now.

Because these forgiveness benefits are available for anyone with fasfa student loans that are employed by the government on any level including the state, local and federal levels, qualifying from the employment standpoint is a breeze.

Just maintain your employment and work full time, do this and after you have made the required 120 monthly payments you will receive complete loan forgiveness on your student loan balance.

Also because student loan forgiveness for federal employees falls under the public service loan forgiveness Act, if you don’t intend on working for the state, federal or local government for at least ten years, then you can still have a chance to still get your student loans forgiven.

What we mean is, is that if you say are teacher or a nurse you still can be considered a public servant and could possibly qualify.

Borrowers that are: Teachers, Nurses, Non-Profit workers, in the Peace Corps or in the AmeriCorps all qualify for public servant loan forgiveness.

Another cool thing to note is that you can mix up your career titles and industries and still qualify. For example, you can do 5 years of teaching, two years of state employment and three more years of nursing at a qualified facility and receive student loan forgiveness after 10 years under the public service loan forgiveness program.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Keys to Remember for Government Employee Forgiveness

These are some of the main notes we would hope that you definitely remember and take away from this article blog. For certain these following conditions must be satisfy by yourself or any person looking to partake in public student loan forgiveness and in order to qualify for federal or state employee student loan forgiveness benefits.

A person needs to have received their student loan under the William D. Ford Federal Direct Loan Program. And these loans cannot be in default or any other bad loan status

120 monthly payments must be made. Direct Loan payments should be in-full, on-time and scheduled monthly.

Individuals must make those 120 monthly payments while enrolled in a qualifying Federal Student Loan Repayment Plan

You need to be actively working in a full-time position at a qualifying public service organization, all government positions will work, at the time each of those 120 monthly payments were made.

Student loan forgiveness for federal employees does not work with just any loan type. Make sure you have a Federal Direct Loan

Also the program is Policeman, Park Recreation, Tax Collector office worker and Firefighter friendly.

Closing Remarks

The public service loan forgiveness or PSLF forgiveness program can be possibly the best give a career in public service and working for our government can provide if you can qualify

As awesome as the program is the process can be tricky and professional assistance may deem appropriate for those seeking to get the most out of the program. Also, ensuring all possible forgiveness is received.

Even with all the noise going around about student loan forgiveness in 2017 and recent years, we find that servicers still look to their best interest which is to make as much money as possible off of your student loans and may seek to downplay the reality of student loan forgiveness for government employees

Because of this we encourage you to do your research, speak to student loan consultant and ask questions. By speaking with an experienced person that does not have any interest in making money off of your student loans may be your most solid step in your path to receiving student loan forgiveness for government employees

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

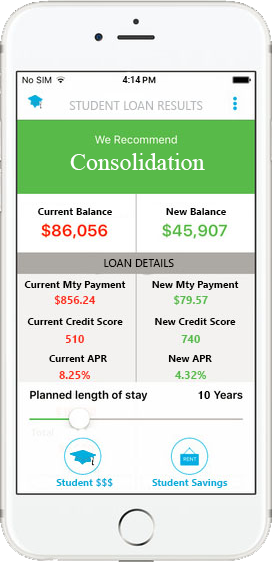

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments