2024

Easy to qualify programs for student loan relief

…I made the call and walked away with my loans forgiven!

You Should Call

What Is Student Loan Refinance?

Daniel Morgan

Updated – Jan 6th 2024

In 2024 the refinance of student loans has become a hot trend for students looking or a way to save on their student loans and interest rates. What is Student Loan Refinance, we will get to that in a moment.

In today’s world most people interested in furthering their education look to attend a college or university. Most of us do not have thousands of dollars stored away or had parents that needed to put most of the finances toward supporting the family’s everyday needs or to keep food on the table, which did not leave much money to place in the college fund.

Therefore, based on study 93% of students take out student loans to pay for their higher education tuition.

However, out of that percentage the majority of student are not aware of responsibilities that are acquired with the decision to take out student loans.

Paying back on those student loans is one thing but did you know the average student will pay back 2x the loan balance because of the interest on the loans.

Some borrowers can have very high interest rates depending on what type of student loans they have. So the question may come up, is refinancing student loans to lower interest rates an option.

Well, we are going to discuss this topic a little bit and try and shine some light on this notion. And, answer the question What is Student Loan Refinance?

Federal Student Loan Refinancing and Interest

Refinancing federal student loans is a process many students and borrowers find to be very beneficial.

Refinancing federal student loans can help with decreasing your interest rate or get a weighted average interest rate for your student loan.

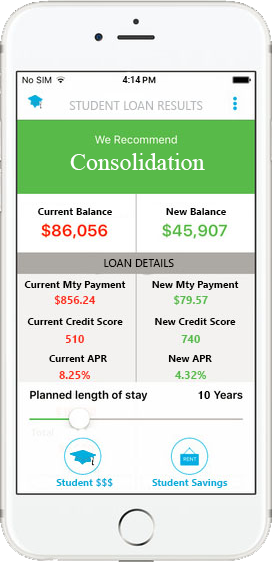

The refinancing of your federal student loans is basically consolidation, when it comes to student loans.

Also, the federal government does consolidation student loans which can have many benefits for a person.

Some of those benefits are as follows

- Reduce Monthly Payments

- One Monthly Payment

- Deferment Programs

- Forbearance Programs

- Alternative repayment options

Federal consolidation loan will take all of the interest rates of the existing student loans, then combine them round them off to the lower whole percentage providing the borrower with a new weighted average of the interest rates.

The result is a rate that instead of having some rates that are somewhat loan and others that higher, you will have a single rate that is more manageable.

Consolidation has additional benefits like the ability to change from the current servicer to one you wish to work with, as well as potentially qualify for additional repayment and forgiveness options.

However these options will have no merit on a lower interest rate.

Also, federal student loans can have fixed and variable rates. Variable interest rates are interest rates that can increase as changes in the economic system take place.

When you consolidate your federal student loans any existing variable rates will be changed to be included in your new consolidated loans single fixed rate. Good to recognize for understanding what is Student Loan Refinance.

Another way to Reduce your Student Loan Interest Rate

If you have federal student loans and want to keep their protections, you may have options other than refinancing to lower your interest rates, Some servicers may reduce your rate if you elect to sign up for automatic payments.

It also may be possible to reduce your interest rate if you make a set number of on-time payments in a row. Therefore, consult with a professional and ask about these benefits or others.

Furthermore, think about possibility paying extra on your student loan payment every month. Federal student loan consolidations usually can reward you with a no penalty for prepayment clause in your agreement.

And paying off your loans faster can reduce the amount of interest you pay overall, even if your rate stays the same.

Can you refinance

your student loans?

CALL TO FIND OUT

833-782-7133

Private Student Loan Refinancing and Interest Rates

When looking to refinance a private student loan, like federal student loans there are many things to look at and consider before you decide to sign on the line.

The federal government does not refinance private student loans. In order to refinance a private student loan you must be open to work with private financial institutions like banks and private lenders.

Banks and other financial institutions have options to refinance federal student loans as well as private student loans. They can actually refinance them together into one loan

However it is very important to understand that there is a risk to refinancing your federal student loans into a private loan. Here are a few things to keep in mind:

Loss of federal student loan rights

When you refinance your federal loans into a private loan you are essentially saying goodbye to your federal student loan and saying hello a new private loan.

Once this process has been fulfilled any and all federal rights you had by law will no longer apply to your new loan.

Option for a fixed interest rate

Unlike federal student loans which usually will give you a fixed rate and if not you can get a fixed rate by federal student loan consolidation.

With private student loans lenders will decide what type of interest rate will be offered to you.

Banks and private lenders will use your credit score and rating to determine what type of interest rate will be offered to you and how much that rate will be.

In many cases, a bank will present to you a variable rate and may not even offer you a fixed rate at all.

So, if you did not graduate they may even turn down your application for student refinancing all together based on your credit.

Repayment Options

For individuals in a financial hardship or having a hard time making their minimum payments on their student loans.

The government provides alternative repayment options to help borrowers in these cases.

When you refinance your student loan into private loan you lose this benefit.

The option to have your payment reduced to enter into an income driven repayment.

However, these most likely will not be available in a private refinancing of your student loans.

Benefits to private student loan refinancing

If you are interested in looking to use student refinancing to reduce your student loan interest rate. Then, private student loan refinancing may be the answer for you.

Currently many of the lenders out there are offering very good interest rates for student loan refinancing. Also, with some interest rates as low as 2.8%

However be sure to ask questions, some lenders will offer you a lower interest rate to start out with. But, over time the interest rate will increase to a higher rate down the road.

Need your monthly payments reduced?

Fine out if you can get total loan forgiveness!

833-782-7133

Take away

Let’s take some key notes to remember if you are considering refinancing your student loans to lower interest rates.

- Federal student loans can have a fixed or variable interest rate

- Federal student loan services may lower your interest rate if you opt into an automatic payment

- Private student loan refinancing will result in loss of federals student loan rights for federal student loans

- Banks and lenders can refinance federal and private student loans together

- Banks use your credit score and report to determine what they will offer you as an interest rate for your student loan refinance

- Private loan refinance can help lower your interest rate.

Refinancing student loans is very helpful but may not be for everyone.

We suggest that you work with a professional that can point you in the right direction

Refinancing student loans to lower interest rates is very possible and can save you a lot of money over time.

In Conclusion, now the question “What is student loan refinance” has been answered for you.

Other Related Articles

Student Loans 2024

The BIDEN Presidency

& it’s impact on:

- Student loan forgiveness

- Government loan programs

- Student repayment options

Recent Posts

Archives

Categories

Meta

GOV Student Loan Service student loan refinancing program can save you major time and money and we can prove it!

Hands Down

Recent Comments